- France

- /

- Hospitality

- /

- ENXTPA:MLCMB

Is It Worth Buying Compagnie Du Mont-Blanc (EPA:MLCMB) For Its 3.0% Dividend Yield?

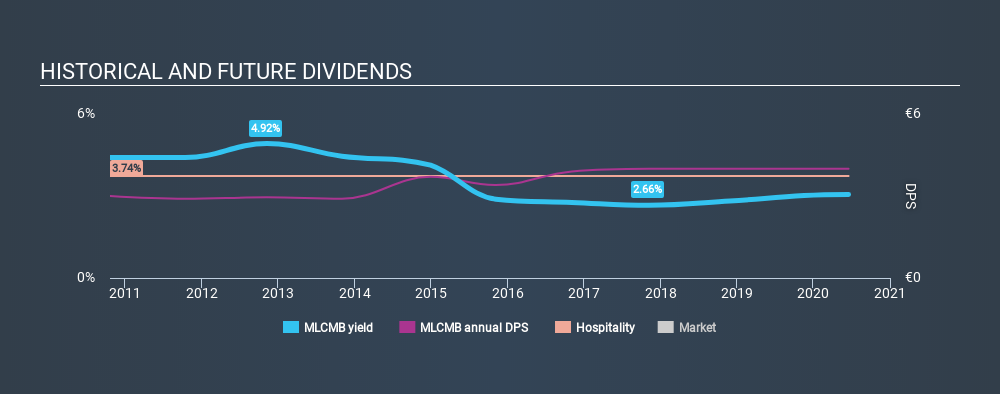

Dividend paying stocks like Compagnie Du Mont-Blanc (EPA:MLCMB) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

A 3.0% yield is nothing to get excited about, but investors probably think the long payment history suggests Compagnie Du Mont-Blanc has some staying power. Some simple research can reduce the risk of buying Compagnie Du Mont-Blanc for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Compagnie Du Mont-Blanc paid out 19% of its profit as dividends, over the trailing twelve month period. We like this low payout ratio, because it implies the dividend is well covered and leaves ample opportunity for reinvestment.

We update our data on Compagnie Du Mont-Blanc every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of Compagnie Du Mont-Blanc's dividend payments. The dividend has been stable over the past 10 years, which is great. We think this could suggest some resilience to the business and its dividends. During the past ten-year period, the first annual payment was €3.00 in 2010, compared to €4.00 last year. This works out to be a compound annual growth rate (CAGR) of approximately 2.9% a year over that time.

While the consistency in the dividend payments is impressive, we think the relatively slow rate of growth is unappealing.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Compagnie Du Mont-Blanc has grown its earnings per share at 24% per annum over the past five years. Earnings per share have grown rapidly, and the company is retaining a majority of its earnings. We think this is ideal from an investment perspective, if the company is able to reinvest these earnings effectively.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're glad to see Compagnie Du Mont-Blanc has a low payout ratio, as this suggests earnings are being reinvested in the business. Next, growing earnings per share and steady dividend payments is a great combination. Compagnie Du Mont-Blanc fits all of our criteria, and we think there are a lot of positives to it from a dividend perspective.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, Compagnie Du Mont-Blanc has 4 warning signs (and 2 which are significant) we think you should know about.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About ENXTPA:MLCMB

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives