- Canada

- /

- Construction

- /

- TSX:BDT

Is It Time To Consider Buying Bird Construction Inc. (TSE:BDT)?

Bird Construction Inc. (TSE:BDT), which is in the construction business, and is based in Canada, received a lot of attention from a substantial price increase on the TSX over the last few months. With many analysts covering the stock, we may expect any price-sensitive announcements have already been factored into the stock’s share price. However, could the stock still be trading at a relatively cheap price? Let’s examine Bird Construction’s valuation and outlook in more detail to determine if there’s still a bargain opportunity.

See our latest analysis for Bird Construction

What is Bird Construction worth?

Bird Construction appears to be overvalued according to my relative valuation model. I’ve used the price-to-earnings ratio in this instance because there’s not enough visibility to forecast its cash flows. The stock’s ratio of 36.11x is currently well-above the industry average of 17.1x, meaning that it is trading at a more expensive price relative to its peers. But, is there another opportunity to buy low in the future? Given that Bird Construction’s share is fairly volatile (i.e. its price movements are magnified relative to the rest of the market) this could mean the price can sink lower, giving us another chance to buy in the future. This is based on its high beta, which is a good indicator for share price volatility.

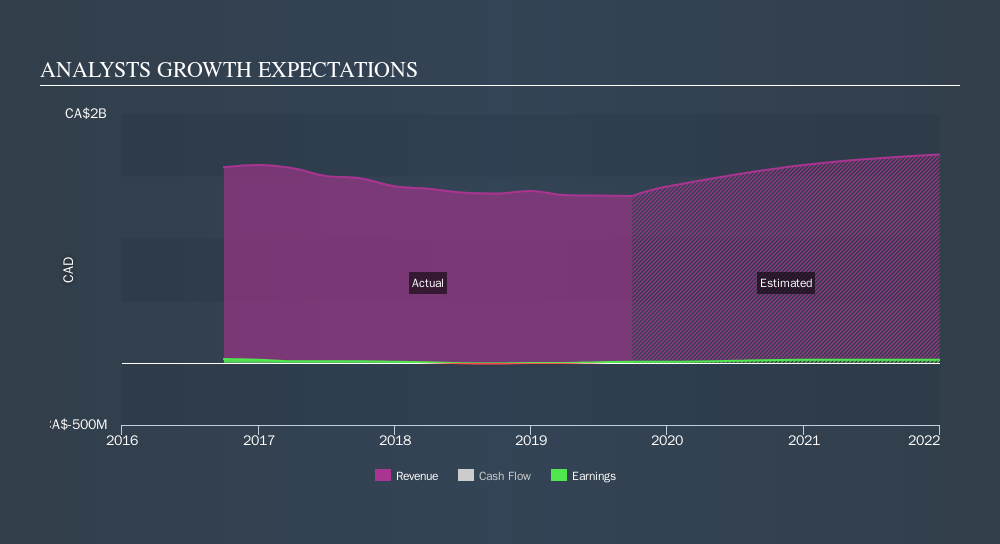

What kind of growth will Bird Construction generate?

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. Bird Construction’s earnings over the next few years are expected to double, indicating a very optimistic future ahead. This should lead to stronger cash flows, feeding into a higher share value.

What this means for you:

Are you a shareholder? BDT’s optimistic future growth appears to have been factored into the current share price, with shares trading above its fair value. At this current price, shareholders may be asking a different question – should I sell? If you believe BDT should trade below its current price, selling high and buying it back up again when its price falls towards its real value can be profitable. But before you make this decision, take a look at whether its fundamentals have changed.

Are you a potential investor? If you’ve been keeping an eye on BDT for a while, now may not be the best time to enter into the stock. The price has surpassed its industry peers, which means it is likely that there is no more upside from mispricing. However, the optimistic prospect is encouraging for BDT, which means it’s worth diving deeper into other factors in order to take advantage of the next price drop.

Price is just the tip of the iceberg. Dig deeper into what truly matters – the fundamentals – before you make a decision on Bird Construction. You can find everything you need to know about Bird Construction in the latest infographic research report. If you are no longer interested in Bird Construction, you can use our free platform to see my list of over 50 other stocks with a high growth potential.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:BDT

Bird Construction

Provides construction services in Canada.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Beyond 2026, Beyond a Double

A case for TSXV:AUMB to reach USD$2.69 (CAD$3.70) by 2030 (15X).

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion

Figma is still deeply embedded as the default design system in big companies, and the ecosystem (Buzz, Slides, Sites, Make) is clearly the strategic play rather than a one‑off product bet. None of those qualitative assumptions have really broken yet, the bigger change has been sentiment toward growth/AI software in general, not Figma’s product reality. Assuming ~30% annual growth, margins stepping up to 25%, and a 40x PE in 2030 with an 8.4% discount rate is too optimistic now considering how the broader market is now pricing similar SaaS names, which means you can believe in the long term thesis and still accept that the stock might chop sideways or even drift lower while expectations and multiples reset. I will be sharing an update soon.

Nedbank please contact me,l need guidance step by step, please