Is B.R.A.I.N. Biotechnology Research and Information Network (ETR:BNN) Using Debt In A Risky Way?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that B.R.A.I.N. Biotechnology Research and Information Network AG (ETR:BNN) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for B.R.A.I.N. Biotechnology Research and Information Network

What Is B.R.A.I.N. Biotechnology Research and Information Network's Net Debt?

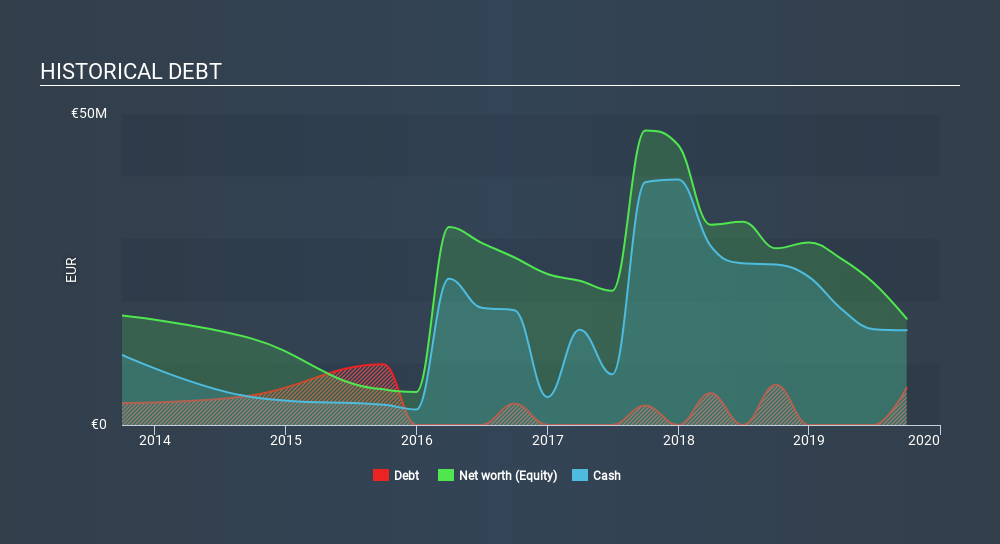

You can click the graphic below for the historical numbers, but it shows that as of September 2019 B.R.A.I.N. Biotechnology Research and Information Network had €5.99m of debt, an increase on €6.5, over one year. However, it does have €15.2m in cash offsetting this, leading to net cash of €9.24m.

How Healthy Is B.R.A.I.N. Biotechnology Research and Information Network's Balance Sheet?

We can see from the most recent balance sheet that B.R.A.I.N. Biotechnology Research and Information Network had liabilities of €14.9m falling due within a year, and liabilities of €34.2m due beyond that. Offsetting these obligations, it had cash of €15.2m as well as receivables valued at €7.10m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €26.7m.

Given B.R.A.I.N. Biotechnology Research and Information Network has a market capitalization of €192.5m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, B.R.A.I.N. Biotechnology Research and Information Network also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if B.R.A.I.N. Biotechnology Research and Information Network can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year B.R.A.I.N. Biotechnology Research and Information Network wasn't profitable at an EBIT level, but managed to grow its revenue by 38%, to €40m. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is B.R.A.I.N. Biotechnology Research and Information Network?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that B.R.A.I.N. Biotechnology Research and Information Network had negative earnings before interest and tax (EBIT), over the last year. And over the same period it saw negative free cash outflow of €10m and booked a €10m accounting loss. However, it has net cash of €9.24m, so it has a bit of time before it will need more capital. B.R.A.I.N. Biotechnology Research and Information Network's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how B.R.A.I.N. Biotechnology Research and Information Network's profit, revenue, and operating cashflow have changed over the last few years.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About XTRA:BNN

BRAIN Biotech

Provides bio-based products and solutions in Germany, the United States, France, the Netherlands, and the United Kingdom.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives