David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Advanced Drainage Systems, Inc. (NYSE:WMS) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Advanced Drainage Systems

What Is Advanced Drainage Systems's Net Debt?

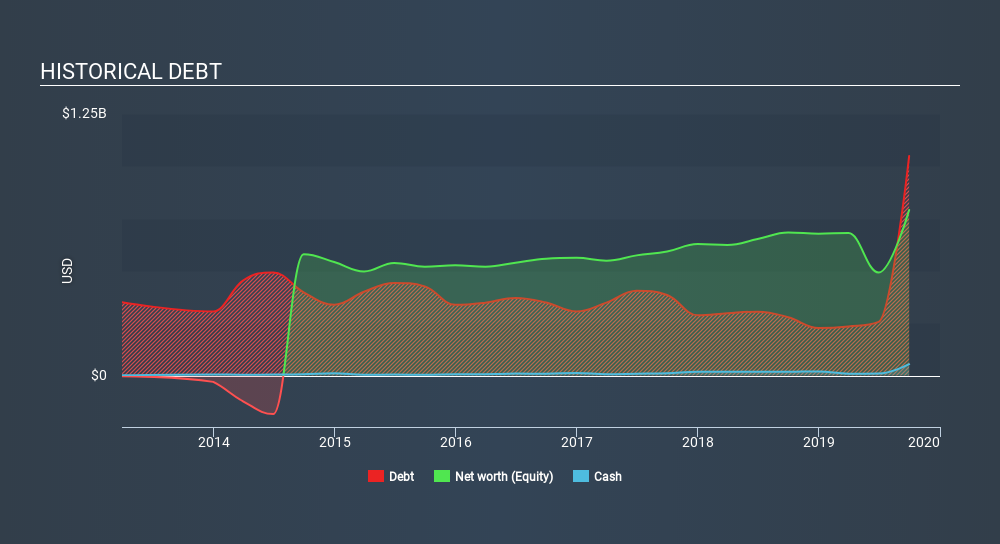

As you can see below, at the end of September 2019, Advanced Drainage Systems had US$1.05b of debt, up from US$278.9m a year ago. Click the image for more detail. However, it also had US$54.2m in cash, and so its net debt is US$995.1m.

A Look At Advanced Drainage Systems's Liabilities

The latest balance sheet data shows that Advanced Drainage Systems had liabilities of US$241.3m due within a year, and liabilities of US$1.26b falling due after that. On the other hand, it had cash of US$54.2m and US$250.5m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$1.20b.

This deficit isn't so bad because Advanced Drainage Systems is worth US$2.91b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While we wouldn't worry about Advanced Drainage Systems's net debt to EBITDA ratio of 4.1, we think its super-low interest cover of 2.3 times is a sign of high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. On the other hand, Advanced Drainage Systems grew its EBIT by 27% in the last year. If sustained, this growth should make that debt evaporate like a scarce drinking water during an unnaturally hot summer. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Advanced Drainage Systems can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Happily for any shareholders, Advanced Drainage Systems actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

Happily, Advanced Drainage Systems's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. But we must concede we find its interest cover has the opposite effect. All these things considered, it appears that Advanced Drainage Systems can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 2 warning signs for Advanced Drainage Systems (1 is concerning) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:WMS

Advanced Drainage Systems

Designs, manufactures, and markets thermoplastic corrugated pipes and related water management products in the United States, Canada, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives