Stock Analysis

- India

- /

- Professional Services

- /

- NSEI:TEAMLEASE

Investors Who Bought TeamLease Services (NSE:TEAMLEASE) Shares Three Years Ago Are Now Up 46%

By buying an index fund, you can roughly match the market return with ease. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. For example, the TeamLease Services Limited (NSE:TEAMLEASE) share price is up 46% in the last three years, clearly besting the market return of around 0.3% (not including dividends).

See our latest analysis for TeamLease Services

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last three years, TeamLease Services failed to grow earnings per share, which fell 24% (annualized).

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

It could be that the revenue growth of 17% per year is viewed as evidence that TeamLease Services is growing. If the company is being managed for the long term good, today's shareholders might be right to hold on.

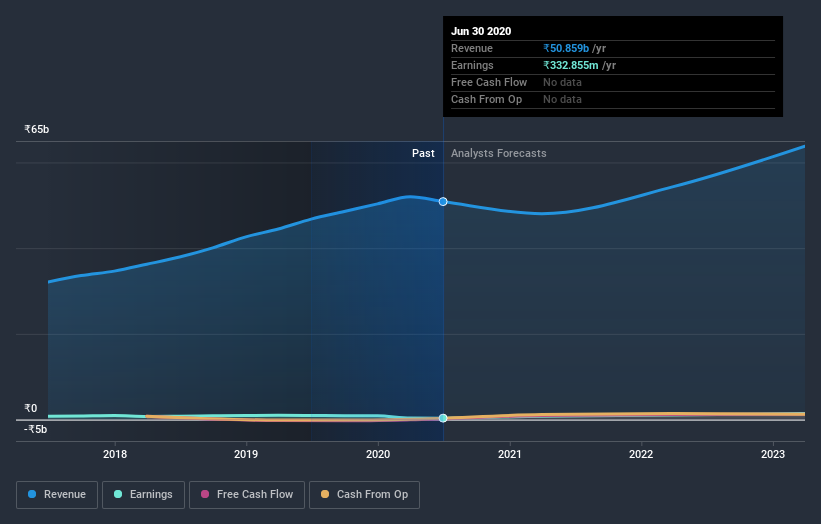

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So it makes a lot of sense to check out what analysts think TeamLease Services will earn in the future (free profit forecasts).

A Different Perspective

The last twelve months weren't great for TeamLease Services shares, which cost holders 23%, while the market was up about 4.4%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Fortunately the longer term story is brighter, with total returns averaging about 13% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. It's always interesting to track share price performance over the longer term. But to understand TeamLease Services better, we need to consider many other factors. For instance, we've identified 4 warning signs for TeamLease Services that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade TeamLease Services, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether TeamLease Services is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:TEAMLEASE

TeamLease Services

Provides human resource services to various industries in India.

Excellent balance sheet with reasonable growth potential.