- United Kingdom

- /

- Consumer Durables

- /

- AIM:VCP

Introducing Victoria (LON:VCP), The Stock That Slid 62% In The Last Three Years

Victoria plc (LON:VCP) shareholders should be happy to see the share price up 16% in the last month. Meanwhile over the last three years the stock has dropped hard. Tragically, the share price declined 62% in that time. So it is really good to see an improvement. While many would remain nervous, there could be further gains if the business can put its best foot forward.

View our latest analysis for Victoria

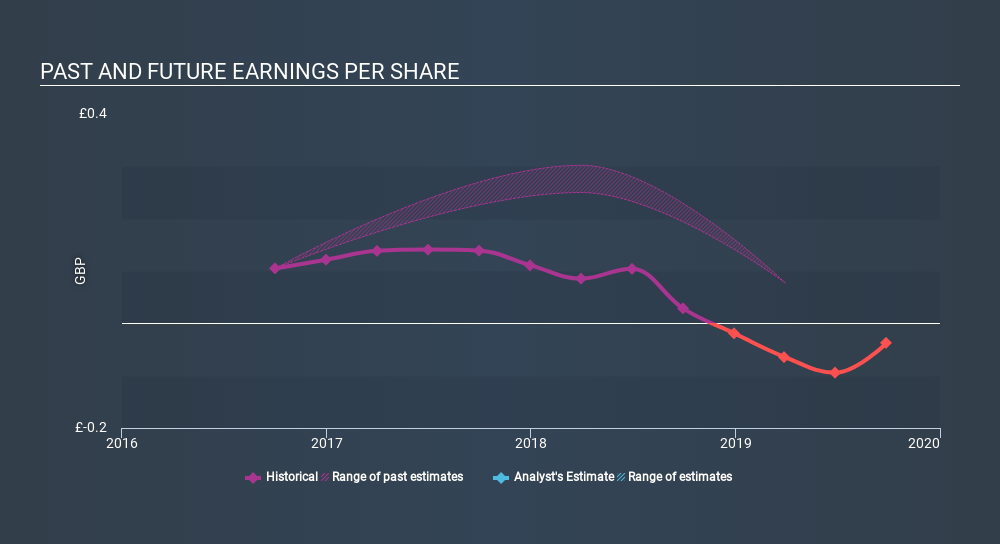

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Victoria saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Extraordinary items contributed to this situation. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. But it's safe to say we'd generally expect the share price to be lower as a result!

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Dive deeper into the earnings by checking this interactive graph of Victoria's earnings, revenue and cash flow.

A Different Perspective

We regret to report that Victoria shareholders are down 62% for the year. Unfortunately, that's worse than the broader market decline of 13%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 2.2%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 4 warning signs for Victoria you should be aware of, and 2 of them are a bit concerning.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:VCP

Victoria

Designs, manufactures, and distributes flooring products primarily in the United Kingdom, Italy, Belgium, Spain, Australia, the Netherlands, Turkey, France, Ireland, Portugal, and the United States.

Undervalued slight.

Similar Companies

Market Insights

Community Narratives