It's not possible to invest over long periods without making some bad investments. But really big losses can really drag down an overall portfolio. So spare a thought for the long term shareholders of Ovintiv Inc. (TSE:OVV); the share price is down a whopping 95% in the last three years. That would certainly shake our confidence in the decision to own the stock. And over the last year the share price fell 93%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 88% in the last 90 days.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for Ovintiv

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Ovintiv became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

Given the healthiness of the dividend payments, we doubt that they've concerned the market. It's good to see that Ovintiv has increased its revenue over the last three years. If the company can keep growing revenue, there may be an opportunity for investors. You might have to dig deeper to understand the recent share price weakness.

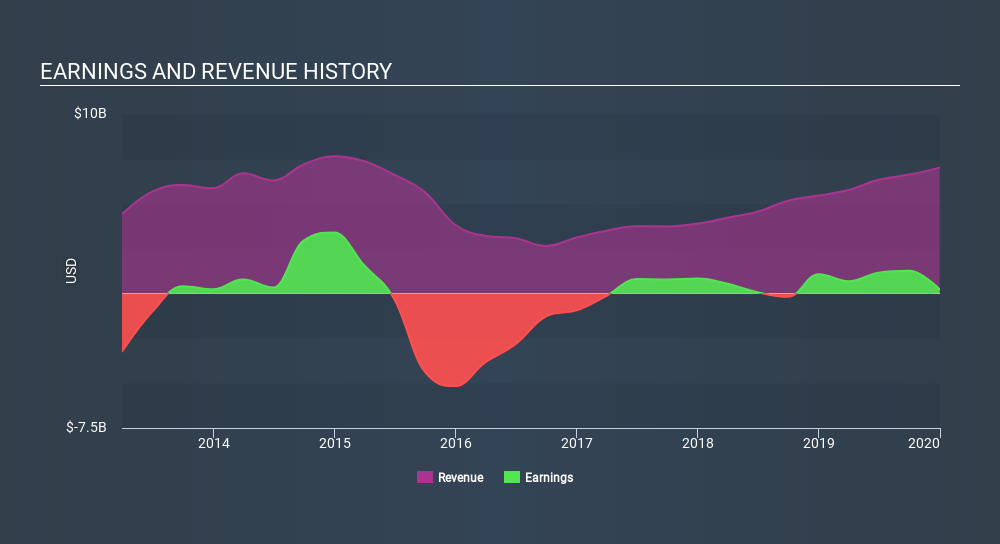

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While the broader market lost about 32% in the twelve months, Ovintiv shareholders did even worse, losing 92% (even including dividends) . Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 44% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Ovintiv better, we need to consider many other factors. Take risks, for example - Ovintiv has 6 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:OVV

Ovintiv

Explores, develops, produces, and markets natural gas, oil, and natural gas liquids in North America.

Good value slight.

Similar Companies

Market Insights

Community Narratives