- India

- /

- Commercial Services

- /

- NSEI:YAARI

Indiabulls Integrated Services' (NSE:IBULISL) Wonderful 359% Share Price Increase Shows How Capitalism Can Build Wealth

For many, the main point of investing in the stock market is to achieve spectacular returns. While not every stock performs well, when investors win, they can win big. To wit, the Indiabulls Integrated Services Limited (NSE:IBULISL) share price has soared 359% over five years. This just goes to show the value creation that some businesses can achieve. On top of that, the share price is up 38% in about a quarter. But this move may well have been assisted by the reasonably buoyant market (up 27% in 90 days).

Check out our latest analysis for Indiabulls Integrated Services

Because Indiabulls Integrated Services made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Indiabulls Integrated Services saw its revenue shrink by 4.1% per year. This is in stark contrast to the strong share price growth of 36%, compound, per year. Obviously, whatever the market is excited about, it's not a track record of revenue growth. I think it's fair to say there is probably a fair bit of excitement in the price.

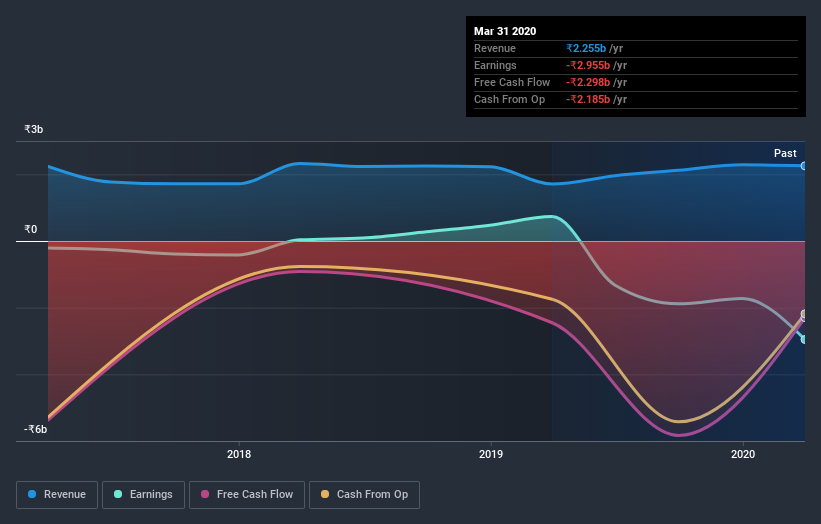

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Investors in Indiabulls Integrated Services had a tough year, with a total loss of 47%, against a market gain of about 10%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 36% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with Indiabulls Integrated Services (including 1 which is is a bit concerning) .

We will like Indiabulls Integrated Services better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you’re looking to trade Indiabulls Integrated Services, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:YAARI

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives