Top Global Limited (SGX:BHO) shareholders will doubtless be very grateful to see the share price up 33% in the last month. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Five years have seen the share price descend precipitously, down a full 72%. So we don't gain too much confidence from the recent recovery. The million dollar question is whether the company can justify a long term recovery.

See our latest analysis for Top Global

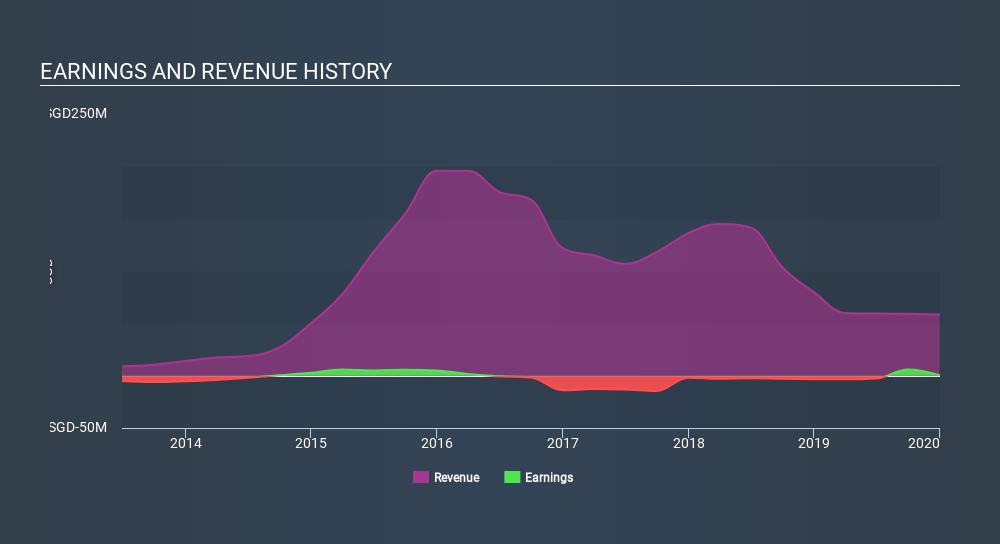

Given that Top Global only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over half a decade Top Global reduced its trailing twelve month revenue by 11% for each year. That's definitely a weaker result than most pre-profit companies report. So it's not altogether surprising to see the share price down 22% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Top Global stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Top Global shareholders have received a total shareholder return of 12% over one year. There's no doubt those recent returns are much better than the TSR loss of 22% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Top Global (1 is concerning!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Market Insights

Community Narratives