Imagine Owning Pro-Pac Packaging (ASX:PPG) And Trying To Stomach The 77% Share Price Drop

Generally speaking long term investing is the way to go. But along the way some stocks are going to perform badly. For example, after five long years the Pro-Pac Packaging Limited (ASX:PPG) share price is a whole 77% lower. That is extremely sub-optimal, to say the least. We also note that the stock has performed poorly over the last year, with the share price down 39%.

See our latest analysis for Pro-Pac Packaging

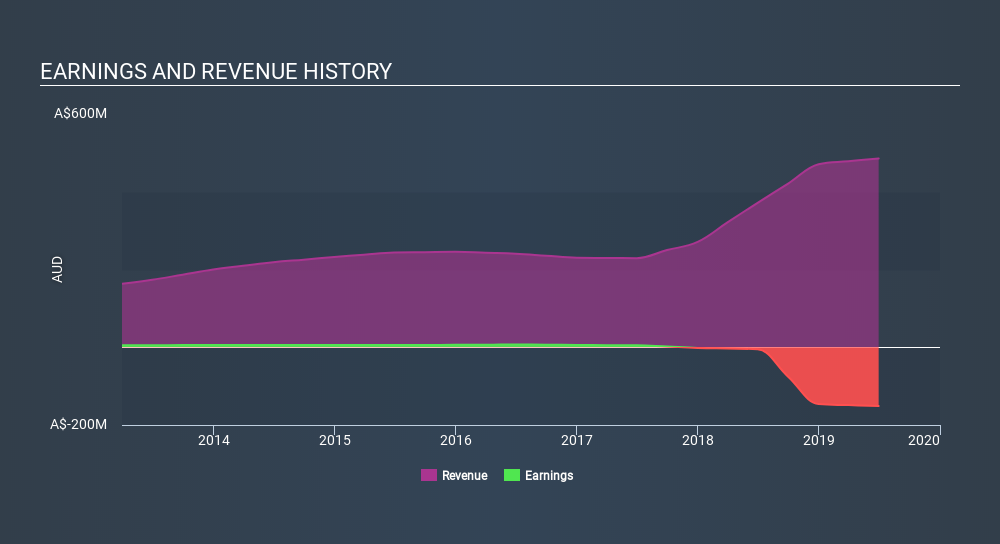

Given that Pro-Pac Packaging didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Pro-Pac Packaging saw its revenue increase by 17% per year. That's better than most loss-making companies. So on the face of it we're really surprised to see the share price has averaged a fall of 26% each year, in the same time period. You'd have to assume the market is worried that profits won't come soon enough. While there might be an opportunity here, you'd want to take a close look at the balance sheet strength.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Pro-Pac Packaging's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Pro-Pac Packaging's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Pro-Pac Packaging's TSR, which was a 68% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

While the broader market gained around 21% in the last year, Pro-Pac Packaging shareholders lost 39%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 20% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Pro-Pac Packaging has 4 warning signs (and 2 which shouldn't be ignored) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:PPG

Pro-Pac Packaging

Manufactures and distributes flexible and industrial packaging products in Australia and New Zealand.

Slight and slightly overvalued.

Market Insights

Community Narratives