Investing in stocks comes with the risk that the share price will fall. And unfortunately for Movado Group, Inc. (NYSE:MOV) shareholders, the stock is a lot lower today than it was a year ago. The share price is down a hefty 56% in that time. Notably, shareholders had a tough run over the longer term, too, with a drop of 37% in the last three years. Furthermore, it's down 24% in about a quarter. That's not much fun for holders.

See our latest analysis for Movado Group

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Movado Group stole the show with its EPS rocketing, in the last year. The rate of growth may not be sustainable, but it is still really positive. So we are surprised the share price is down. So it's worth taking a look at some other metrics.

Movado Group's dividend seems healthy to us, so we doubt that the yield is a concern for the market. From what we can see, revenue is pretty flat, so that doesn't really explain the share price drop. Of course, it could simply be that it simply fell short of the market consensus expectations.

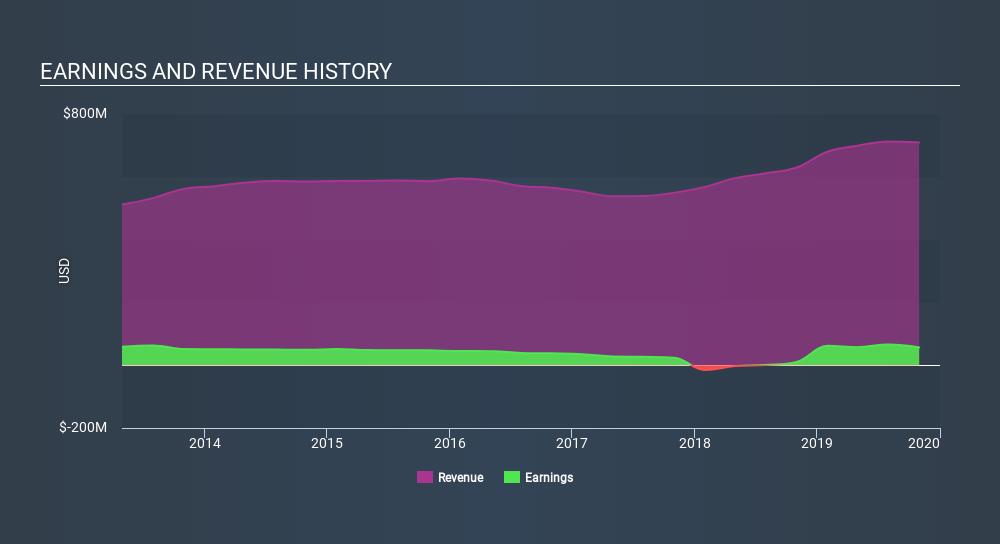

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Movado Group has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Movado Group in this interactive graph of future profit estimates.

What about the Total Shareholder Return (TSR)?

We've already covered Movado Group's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Movado Group shareholders, and that cash payout explains why its total shareholder loss of 55%, over the last year, isn't as bad as the share price return.

A Different Perspective

While the broader market gained around 16% in the last year, Movado Group shareholders lost 55% (even including dividends) . Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 7.8% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Be aware that Movado Group is showing 3 warning signs in our investment analysis , and 1 of those is potentially serious...

We will like Movado Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:MOV

Movado Group

Designs, sources, markets, and distributes watches worldwide.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives