Imagine Owning Fellow Finance Oyj (HEL:FELLOW) And Wondering If The 45% Share Price Slide Is Justified

While it may not be enough for some shareholders, we think it is good to see the Fellow Finance Oyj (HEL:FELLOW) share price up 23% in a single quarter. But that doesn't change the reality of under-performance over the last twelve months. After all, the share price is down 45% in the last year, significantly under-performing the market.

View our latest analysis for Fellow Finance Oyj

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

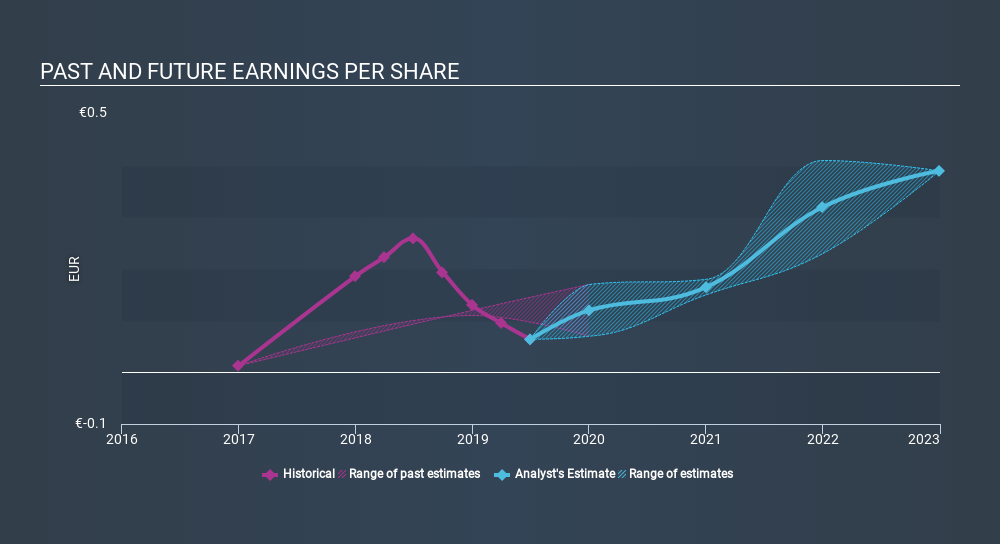

Unfortunately Fellow Finance Oyj reported an EPS drop of 75% for the last year. This fall in the EPS is significantly worse than the 45% the share price fall. It may have been that the weak EPS was not as bad as some had feared. With a P/E ratio of 62.18, it's fair to say the market sees an EPS rebound on the cards.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Fellow Finance Oyj's earnings, revenue and cash flow.

A Different Perspective

Given that the market gained 14% in the last year, Fellow Finance Oyj shareholders might be miffed that they lost 45% (even including dividends) . However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Putting aside the last twelve months, it's good to see the share price has rebounded by 23%, in the last ninety days. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 3 warning signs we've spotted with Fellow Finance Oyj .

We will like Fellow Finance Oyj better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About HLSE:ALISA

Alisa Pankki Oyj

Provides various banking and financial services to personal and business consumers in Finland, Denmark, and Germany.

Moderate growth potential and slightly overvalued.

Market Insights

Community Narratives