If You Had Bought XLMedia (LON:XLM) Stock Five Years Ago, You Could Pocket A 47% Gain Today

It hasn't been the best quarter for XLMedia PLC (LON:XLM) shareholders, since the share price has fallen 14% in that time. But that doesn't change the fact that the returns over the last five years have been pleasing. After all, the share price is up a market-beating 47% in that time. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 25% drop, in the last year.

See our latest analysis for XLMedia

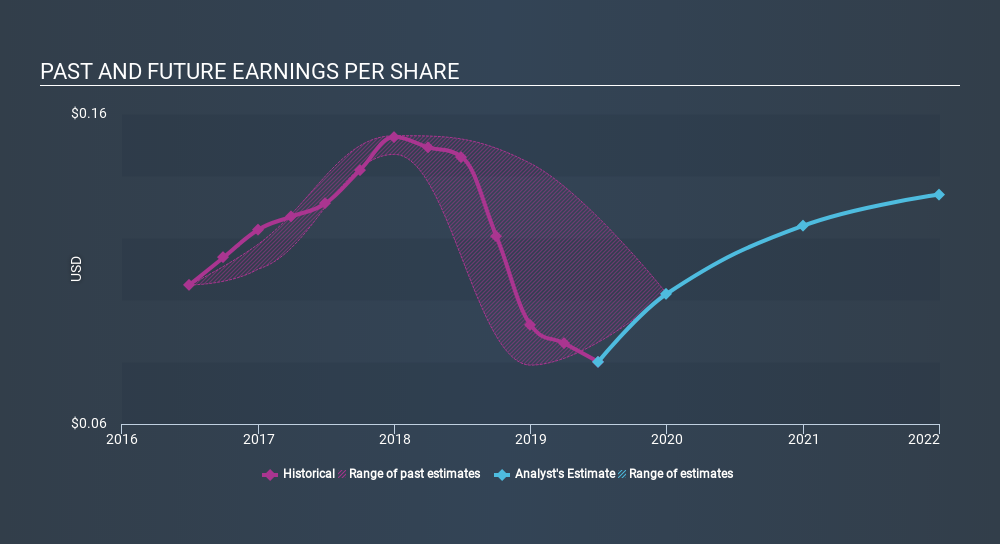

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, XLMedia achieved compound earnings per share (EPS) growth of 10% per year. This EPS growth is higher than the 8.0% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock. This cautious sentiment is reflected in its (fairly low) P/E ratio of 10.30.

The company's earnings per share (over time) are depicted in the image below.

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Dive deeper into the earnings by checking this interactive graph of XLMedia's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of XLMedia, it has a TSR of 95% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

XLMedia shareholders are down 17% for the year (even including dividends) , but the market itself is up 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 14%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:XLM

XLMedia

Operates as a digital media company that creates content for audiences and connects them to relevant advertisers in North America and Europe.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives