- Canada

- /

- Specialty Stores

- /

- TSX:XAU

If You Had Bought Goldmoney (TSE:XAU) Stock Five Years Ago, You'd Be Sitting On A 45% Loss, Today

Goldmoney Inc. (TSE:XAU) shareholders will doubtless be very grateful to see the share price up 33% in the last quarter. But over the last half decade, the stock has not performed well. In fact, the share price is down 45%, which falls well short of the return you could get by buying an index fund.

See our latest analysis for Goldmoney

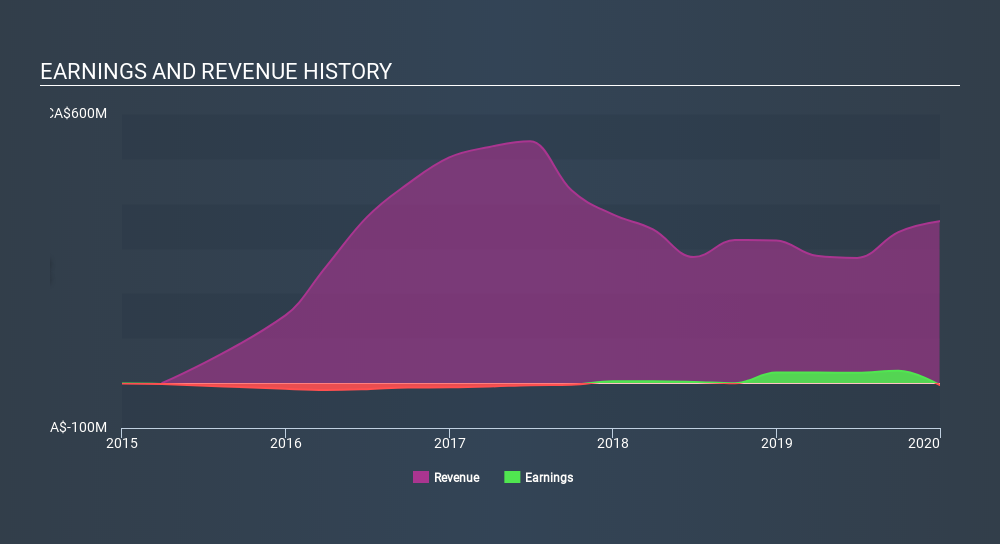

Given that Goldmoney didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, Goldmoney saw its revenue increase by 6.0% per year. That's not a very high growth rate considering it doesn't make profits. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 11% (annualized) in the same time frame. The key question is whether the company can make it to profitability, and beyond, without trouble. Shareholders will want the company to approach profitability if it can't grow revenue any faster.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Goldmoney's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Goldmoney shareholders have received a total shareholder return of 3.8% over the last year. That's including the dividend. That certainly beats the loss of about 11% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Goldmoney has 1 warning sign we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TSX:XAU

Goldmoney

Through its subsidiaries, engages in the precious metals and real asset businesses worldwide.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives