- United States

- /

- Electrical

- /

- NYSE:GNRC

If You Had Bought Generac Holdings (NYSE:GNRC) Shares Three Years Ago You'd Have Made 160%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But in contrast you can make much more than 100% if the company does well. For example, the Generac Holdings Inc. (NYSE:GNRC) share price has soared 160% in the last three years. How nice for those who held the stock! Also pleasing for shareholders was the 18% gain in the last three months. But this could be related to the strong market, which is up 11% in the last three months.

View 1 warning sign we detected for Generac Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

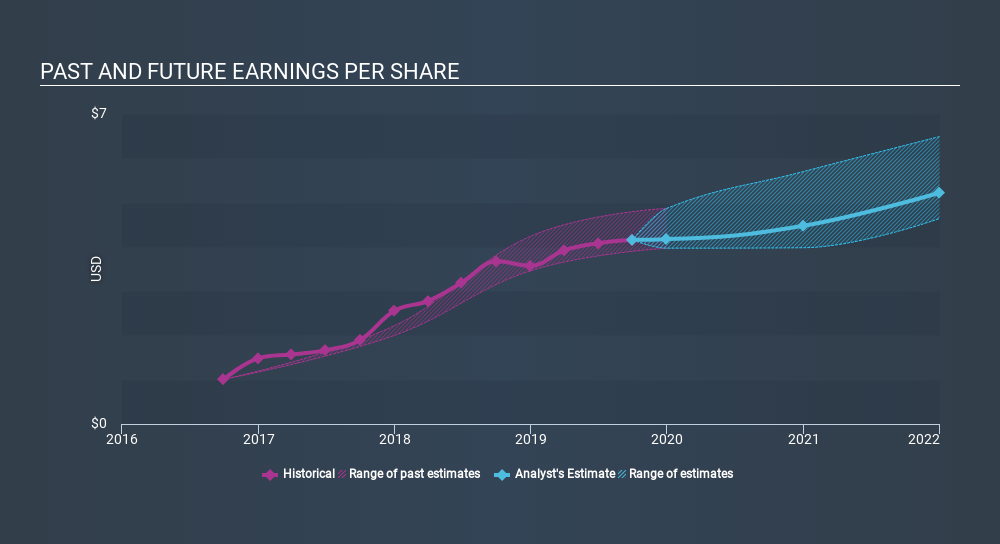

During three years of share price growth, Generac Holdings achieved compound earnings per share growth of 60% per year. The average annual share price increase of 37% is actually lower than the EPS growth. So one could reasonably conclude that the market has cooled on the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Generac Holdings has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that Generac Holdings shareholders have received a total shareholder return of 84% over one year. That's better than the annualised return of 17% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. If you would like to research Generac Holdings in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

Of course Generac Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:GNRC

Generac Holdings

Designs, manufactures, and distributes energy technology products and solution worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives