- Denmark

- /

- Medical Equipment

- /

- CPSE:DEMANT

How Much is Demant A/S's (CPH:DEMANT) CEO Getting Paid?

Søren Nielsen became the CEO of Demant A/S (CPH:DEMANT) in 2017. First, this article will compare CEO compensation with compensation at similar sized companies. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

View our latest analysis for Demant

How Does Søren Nielsen's Compensation Compare With Similar Sized Companies?

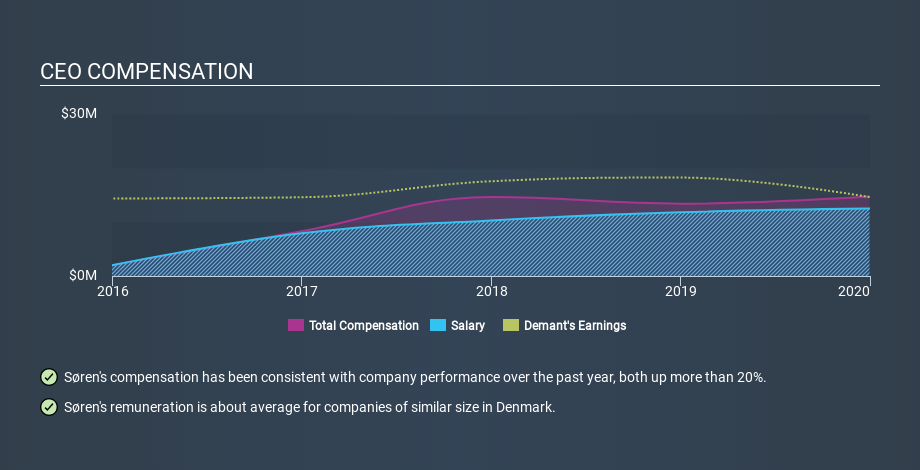

According to our data, Demant A/S has a market capitalization of ø49b, and paid its CEO total annual compensation worth ø15m over the year to December 2019. Notably, that's an increase of 9.7% over the year before. We think total compensation is more important but we note that the CEO salary is lower, at ø13m. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of ø26b to ø79b. The median total CEO compensation was ø16m.

So Søren Nielsen receives a similar amount to the median CEO pay, amongst the companies we looked at. Although this fact alone doesn't tell us a great deal, it becomes more relevant when considered against the business performance.

You can see, below, how CEO compensation at Demant has changed over time.

Is Demant A/S Growing?

On average over the last three years, Demant A/S has grown earnings per share (EPS) by 3.7% each year (using a line of best fit). It achieved revenue growth of 7.2% over the last year.

I'd prefer higher revenue growth, but I'm happy with the modest EPS growth. So there are some positives here, but not enough to earn high praise. It could be important to check this free visual depiction of what analysts expect for the future.

Has Demant A/S Been A Good Investment?

I think that the total shareholder return of 40%, over three years, would leave most Demant A/S shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Søren Nielsen is paid around the same as most CEOs of similar size companies.

While we would like to see improved growth metrics, there is no doubt that the total returns have been great, over the last three years. So we can conclude that on this analysis the CEO compensation seems pretty sound. CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Demant (free visualization of insider trades).

If you want to buy a stock that is better than Demant, this free list of high return, low debt companies is a great place to look.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About CPSE:DEMANT

Demant

Operates as a hearing healthcare company in Europe, North America, Asia, Pacific region, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

The Concentration Trap: Why the S&P 500 Is No Longer a 'Safe' Diversifier

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.