The CEO of Micropole S.A. (EPA:MUN) is Christian Poyau, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Micropole pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Micropole

How Does Total Compensation For Christian Poyau Compare With Other Companies In The Industry?

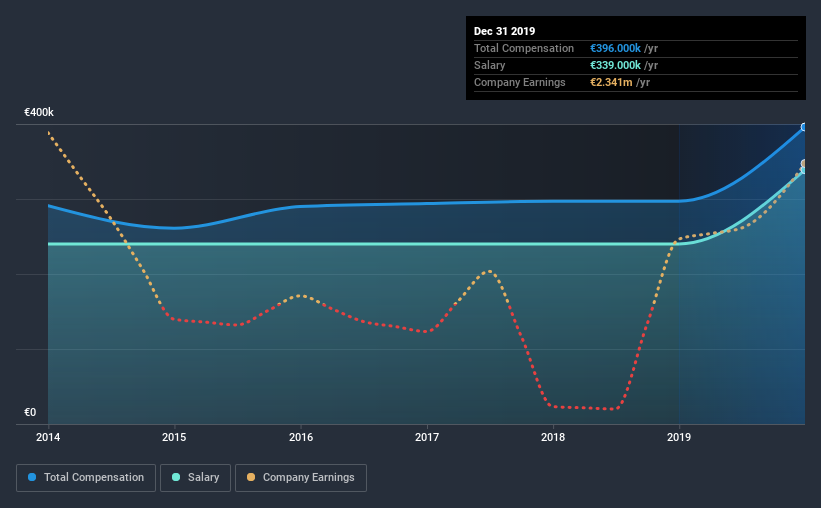

According to our data, Micropole S.A. has a market capitalization of €30m, and paid its CEO total annual compensation worth €396k over the year to December 2019. That's a notable increase of 33% on last year. Notably, the salary which is €339.0k, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below €170m, reported a median total CEO compensation of €270k. Hence, we can conclude that Christian Poyau is remunerated higher than the industry median. Moreover, Christian Poyau also holds €3.7m worth of Micropole stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

Speaking on an industry level, nearly 64% of total compensation represents salary, while the remainder of 36% is other remuneration. It's interesting to note that Micropole pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Micropole S.A.'s Growth Numbers

Over the past three years, Micropole S.A. has seen its earnings per share (EPS) grow by 72% per year. It achieved revenue growth of 5.4% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Micropole S.A. Been A Good Investment?

With a three year total loss of 17% for the shareholders, Micropole S.A. would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As we noted earlier, Micropole pays its CEO higher than the norm for similar-sized companies belonging to the same industry. However, the earnings per share growth is certainly impressive, but it's disappointing to see negative shareholder returns over the same period. Considering overall performance, we can't say Christian is underpaid, in fact compensation is definitely on the higher side.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 3 warning signs for Micropole that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Micropole or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ENXTPA:ALMIC

Micropole

Operates as a consulting, engineering, and IT services company in France and internationally.

Flawless balance sheet moderate.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Freehold: Offers a fantastic growth-income intersection up to $50 WTI. Below $50 WTI, it may offer historic opportunities in terms of ROI.

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

The Concentration Trap: Why the S&P 500 Is No Longer a 'Safe' Diversifier

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.