- Canada

- /

- Energy Services

- /

- TSXV:MCR

How Does Macro Enterprises' (CVE:MCR) CEO Pay Compare With Company Performance?

This article will reflect on the compensation paid to Frank Miles who has served as CEO of Macro Enterprises Inc. (CVE:MCR) since 2008. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Macro Enterprises.

View our latest analysis for Macro Enterprises

Comparing Macro Enterprises Inc.'s CEO Compensation With the industry

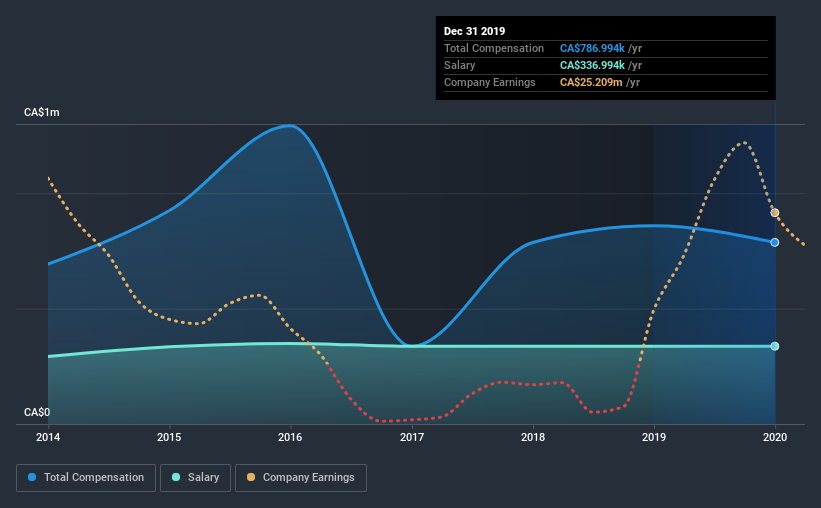

At the time of writing, our data shows that Macro Enterprises Inc. has a market capitalization of CA$72m, and reported total annual CEO compensation of CA$787k for the year to December 2019. Notably, that's a decrease of 8.4% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at CA$337k.

For comparison, other companies in the industry with market capitalizations below CA$272m, reported a median total CEO compensation of CA$1.0m. This suggests that Macro Enterprises remunerates its CEO largely in line with the industry average. Furthermore, Frank Miles directly owns CA$21m worth of shares in the company, implying that they are deeply invested in the company's success.

Speaking on an industry level, nearly 32% of total compensation represents salary, while the remainder of 68% is other remuneration. It's interesting to note that Macro Enterprises pays out a greater portion of remuneration through salary, compared to the industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Macro Enterprises Inc.'s Growth

Macro Enterprises Inc.'s earnings per share (EPS) grew 103% per year over the last three years. It achieved revenue growth of 10% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Macro Enterprises Inc. Been A Good Investment?

Macro Enterprises Inc. has generated a total shareholder return of 31% over three years, so most shareholders would be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

As we touched on above, Macro Enterprises Inc. is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. But earnings growth over the last three years has been impressive, although the same cannot be said for shareholder returns. As a result of these considerations, we would suggest the compensation is reasonable, but looking ahead shareholders will likely want to see healthier returns.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 3 warning signs for Macro Enterprises (2 are potentially serious!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Macro Enterprises, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSXV:MCR

Macro Enterprises

Macro Enterprises Inc. provides pipeline and facilities construction and maintenance services to the oil and gas industry in western Canada.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Alphabet Inc. (GOOG): The Gemini Era – Consolidating AI Dominance in 2026.

Meta Platforms Inc (META): The AI Infrastructure Pivot – Monetizing the Next Frontier in 2026.

Enlight Renewable Energy Ltd. (ENLT): Scaling the Global Green Grid – A 2026 Powerhouse.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Nu holdings will continue to disrupt the South American banking market