Here's Why We Think Beijing Tong Ren Tang Chinese Medicine (HKG:3613) Is Well Worth Watching

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Beijing Tong Ren Tang Chinese Medicine (HKG:3613). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Beijing Tong Ren Tang Chinese Medicine

Beijing Tong Ren Tang Chinese Medicine's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Over the last three years, Beijing Tong Ren Tang Chinese Medicine has grown EPS by 16% per year. That's a pretty good rate, if the company can sustain it.

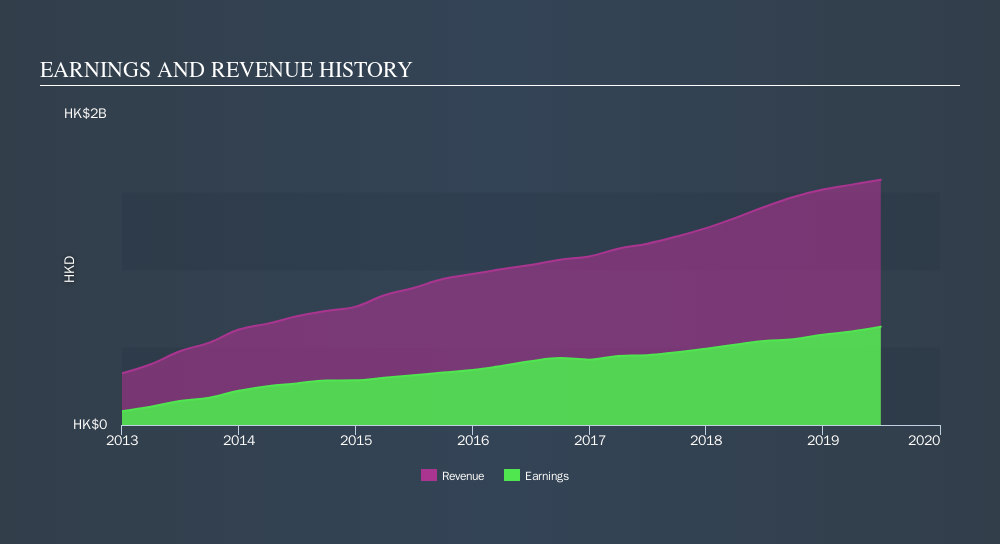

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Beijing Tong Ren Tang Chinese Medicine maintained stable EBIT margins over the last year, all while growing revenue 12% to HK$1.6b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail check this interactive graph.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Beijing Tong Ren Tang Chinese Medicine's future profits.

Are Beijing Tong Ren Tang Chinese Medicine Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Beijing Tong Ren Tang Chinese Medicine shares, in the last year. So it's definitely nice that Chairman Yong Ding bought HK$373k worth of shares at an average price of around HK$12.44.

It's me that Beijing Tong Ren Tang Chinese Medicine insiders are buying the stock, but that's not the only reason to think leader are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalizations between HK$7.8b and HK$25b, like Beijing Tong Ren Tang Chinese Medicine, the median CEO pay is around HK$4.0m.

The Beijing Tong Ren Tang Chinese Medicine CEO received total compensation of just HK$1.7m in the year to December 2018. That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Beijing Tong Ren Tang Chinese Medicine To Your Watchlist?

As I already mentioned, Beijing Tong Ren Tang Chinese Medicine is a growing business, which is what I like to see. Like chocolate chips in vanilla ice cream, the insider buying, and modest CEO pay, make it better. The sum of all that, for me, points to a quality business, and a genuine prospect for further research. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Beijing Tong Ren Tang Chinese Medicine. You might benefit from giving it a glance today.

The good news is that Beijing Tong Ren Tang Chinese Medicine is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:3613

Beijing Tong Ren Tang Chinese Medicine

Engages in the manufacture, retail, and wholesale of healthcare products and Chinese medicine to wholesalers and individuals.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives