For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Abcam (LON:ABC). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Abcam

Abcam's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Abcam managed to grow EPS by 16% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

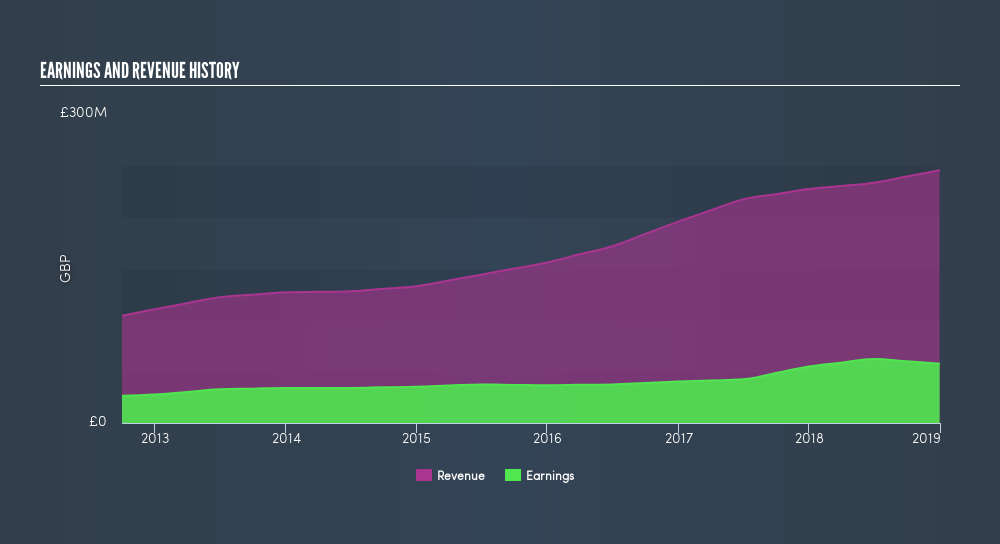

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Abcam is growing revenues, and EBIT margins improved by 3.4 percentage points to 29%, over the last year. That's great to see, on both counts.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Abcam's forecast profits?

Are Abcam Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own Abcam shares worth a considerable sum. Indeed, they have a glittering mountain of wealth invested in it, currently valued at UK£238m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Should You Add Abcam To Your Watchlist?

One important encouraging feature of Abcam is that it is growing profits. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. That combination appeals to me, for one. So yes, I do think the stock is worth keeping an eye on. Now, you could try to make up your mind on Abcam by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:ABC

Abcam

Abcam plc, a life science company, focuses on identifying, developing, and distributing reagents and tools for scientific research, diagnostics, and drug discovery.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives