Here's Why We Don't Think Sinopec Shanghai Petrochemical's (HKG:338) Statutory Earnings Reflect Its Underlying Earnings Potential

As a general rule, we think profitable companies are less risky than companies that lose money. That said, the current statutory profit is not always a good guide to a company's underlying profitability. Today we'll focus on whether this year's statutory profits are a good guide to understanding Sinopec Shanghai Petrochemical (HKG:338).

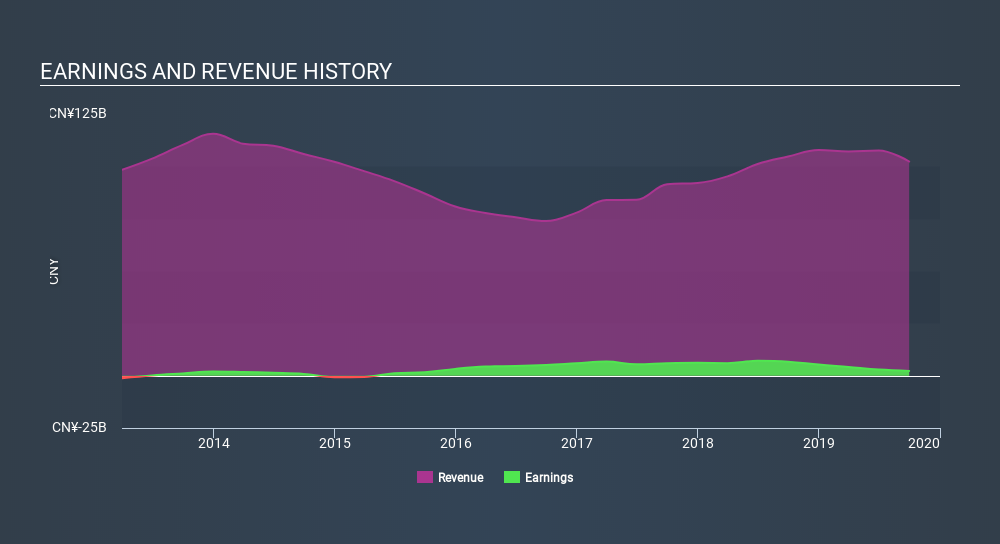

It's good to see that over the last twelve months Sinopec Shanghai Petrochemical made a profit of CN¥2.29b on revenue of CN¥102.3b. As you can see in the chart below, its profit has declined over the last three years, even though its revenue has increased.

See our latest analysis for Sinopec Shanghai Petrochemical

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. In this article we'll look at how Sinopec Shanghai Petrochemical is impacting shareholders by issuing new shares, as well as how unusual items have affected the income line. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, Sinopec Shanghai Petrochemical issued 5.4% more new shares over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Sinopec Shanghai Petrochemical's historical EPS growth by clicking on this link.

How Is Dilution Impacting Sinopec Shanghai Petrochemical's Earnings Per Share? (EPS)

Unfortunately, Sinopec Shanghai Petrochemical's profit is down 55% per year over three years. And even focusing only on the last twelve months, we see profit is down 66%. Like a sack of potatoes thrown from a delivery truck, EPS fell harder, down 68% in the same period. So you can see that the dilution has had a bit of an impact on shareholders.Therefore, the dilution is having a noteworthy influence on shareholder returnsAnd so, you can see quite clearly that dilution is influencing shareholder earnings.

If Sinopec Shanghai Petrochemical's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

How Do Unusual Items Influence Profit?

Alongside that dilution, it's also important to note that Sinopec Shanghai Petrochemical's profit was boosted by unusual items worth CN¥368m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly suprising, given the name. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Sinopec Shanghai Petrochemical's Profit Performance

To sum it all up, Sinopec Shanghai Petrochemical got a nice boost to profit from unusual items; without that, its statutory results would have looked worse. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. Considering all this we'd argue Sinopec Shanghai Petrochemical's profits probably give an overly generous impression of its sustainable level of profitability. While it's really important to consider how well a company's statutory earnings represent its true earnings power, it's also worth taking a look at what analysts are forecasting for the future. So feel free to check out our free graph representing analyst forecasts.

Our examination of Sinopec Shanghai Petrochemical has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:338

Sinopec Shanghai Petrochemical

Manufactures and sells petroleum and chemical products in the People’s Republic of China.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives