- United States

- /

- Food

- /

- NYSE:ADM

Have Archer-Daniels-Midland Company (NYSE:ADM) Insiders Been Selling Their Stock?

We wouldn't blame Archer-Daniels-Midland Company (NYSE:ADM) shareholders if they were a little worried about the fact that Michael D'Ambrose, a company insider, recently netted about US$529k selling shares at an average price of US$46.00. However, that sale only accounted for 5.3% of their holding, so arguably it doesn't say much about their conviction.

See our latest analysis for Archer-Daniels-Midland

The Last 12 Months Of Insider Transactions At Archer-Daniels-Midland

Over the last year, we can see that the biggest insider purchase was by Chairman Juan Luciano for US$1.0m worth of shares, at about US$42.30 per share. So it's clear an insider wanted to buy, at around the current price, which is US$45.71. That means they have been optimistic about the company in the past, though they may have changed their mind. While we always like to see insider buying, it's less meaningful if the purchases were made at much lower prices, as the opportunity they saw may have passed. In this case we're pleased to report that the insider purchases were made at close to current prices.

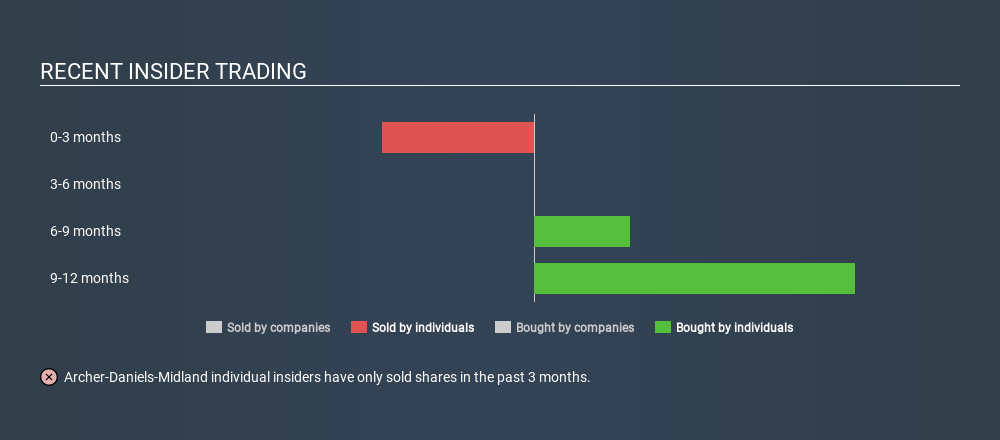

Happily, we note that in the last year insiders paid US$1.6m for 38.51k shares. On the other hand they divested 14000 shares, for US$636k. Overall, Archer-Daniels-Midland insiders were net buyers last year. You can see a visual depiction of insider transactions (by individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

Archer-Daniels-Midland is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Does Archer-Daniels-Midland Boast High Insider Ownership?

Many investors like to check how much of a company is owned by insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. It's great to see that Archer-Daniels-Midland insiders own 0.4% of the company, worth about US$109m. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At Archer-Daniels-Midland Tell Us?

Insiders sold stock recently, but they haven't been buying. On the other hand, the insider transactions over the last year are encouraging. We are also comforted by the high levels of insider ownership. So the recent selling doesn't worry us. Therefore, you should should definitely take a look at this FREE report showing analyst forecasts for Archer-Daniels-Midland.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:ADM

Archer-Daniels-Midland

Engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success