- United Arab Emirates

- /

- Healthcare Services

- /

- ADX:GMPC

Gulf Medical Projects Company (PJSC)'s (ADX:GMPC) Risks Elevated At These Prices

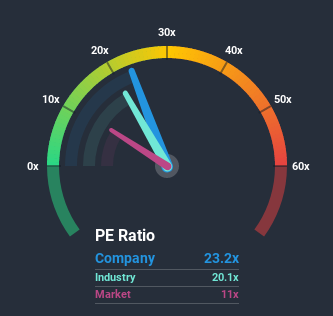

Gulf Medical Projects Company (PJSC)'s (ADX:GMPC) price-to-earnings (or "P/E") ratio of 23.2x might make it look like a strong sell right now compared to the market in the United Arab Emirates, where around half of the companies have P/E ratios below 10x and even P/E's below 6x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

For example, consider that Gulf Medical Projects Company (PJSC)'s financial performance has been poor lately as it's earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Gulf Medical Projects Company (PJSC)

How Does Gulf Medical Projects Company (PJSC)'s P/E Ratio Compare To Its Industry Peers?

We'd like to see if P/E's within Gulf Medical Projects Company (PJSC)'s industry might provide some colour around the company's particularly high P/E ratio. You'll notice in the figure below that P/E ratios in the Healthcare industry are also significantly higher than the market. So this certainly goes a fair way towards explaining the company's ratio right now. In the context of the Healthcare industry's current setting, most of its constituents' P/E's' P/E's would be expected to be raised up greatly. We'd highlight though, the spotlight should be on the anticipated direction of the company's earnings.

How Is Gulf Medical Projects Company (PJSC)'s Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Gulf Medical Projects Company (PJSC)'s is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 40%. As a result, earnings from three years ago have also fallen 95% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

This is in contrast to the rest of the market, which is expected to decline by 23% over the next year, or less than the company's recent medium-term annualised earnings decline.

In light of this, it's odd that Gulf Medical Projects Company (PJSC)'s P/E sits above the majority of other companies. With earnings going quickly in reverse, it's not guaranteed that the P/E has found a floor yet. Maintaining these prices will be extremely difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Gulf Medical Projects Company (PJSC) currently trades on a much higher than expected P/E since its recent three-year earnings are even worse than the forecasts for a struggling market. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is unlikely to support such positive sentiment for long. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough market conditions. Unless the company's relative performance improves markedly, it's very challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Gulf Medical Projects Company (PJSC) (1 is concerning!) that you should be aware of before investing here.

If you're unsure about the strength of Gulf Medical Projects Company (PJSC)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

When trading Gulf Medical Projects Company (PJSC) or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ADX:GMPC

Gulf Medical Projects Company (PJSC)

Manages hospitals in the United Arab Emirates.

Flawless balance sheet and good value.

Market Insights

Community Narratives