- New Zealand

- /

- Banks

- /

- NZSE:HGH

Global Penny Stocks Spotlight: Heartland Group Holdings And 2 Others

Reviewed by Simply Wall St

Amid a backdrop of escalating Middle East tensions and fluctuating oil prices, global markets have experienced mixed performance, with smaller-cap indexes facing notable declines. In such volatile conditions, investors often look for opportunities that combine potential growth with manageable risk. Penny stocks, a term that may seem outdated but remains relevant, represent smaller or newer companies offering lower price points and underappreciated growth potential. By focusing on those with strong financials and solid fundamentals, these stocks can provide an intriguing opportunity for investors seeking value in less-explored corners of the market.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.25 | HK$769.76M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.00 | £449.8M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.68 | SEK275.94M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.445 | SGD180.35M | ✅ 3 ⚠️ 2 View Analysis > |

| Tasmea (ASX:TEA) | A$3.20 | A$751.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.30 | SGD9.05B | ✅ 5 ⚠️ 0 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.385 | SEK2.28B | ✅ 4 ⚠️ 1 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ✅ 5 ⚠️ 0 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.67 | HK$53.16B | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 5,620 stocks from our Global Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Heartland Group Holdings (NZSE:HGH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Heartland Group Holdings Limited, with a market cap of NZ$770.88 million, offers a range of financial services in New Zealand and Australia through its subsidiaries.

Operations: Heartland Group Holdings' revenue is primarily derived from its segments in New Zealand and Australia, including Motor (NZ$40.09 million), Rural (NZ$29.16 million), Business (NZ$23.83 million), Personal Lending (NZ$3.17 million), Reverse Mortgages (NZ$54.55 million), and the Australian Banking Group (NZ$78.39 million).

Market Cap: NZ$770.88M

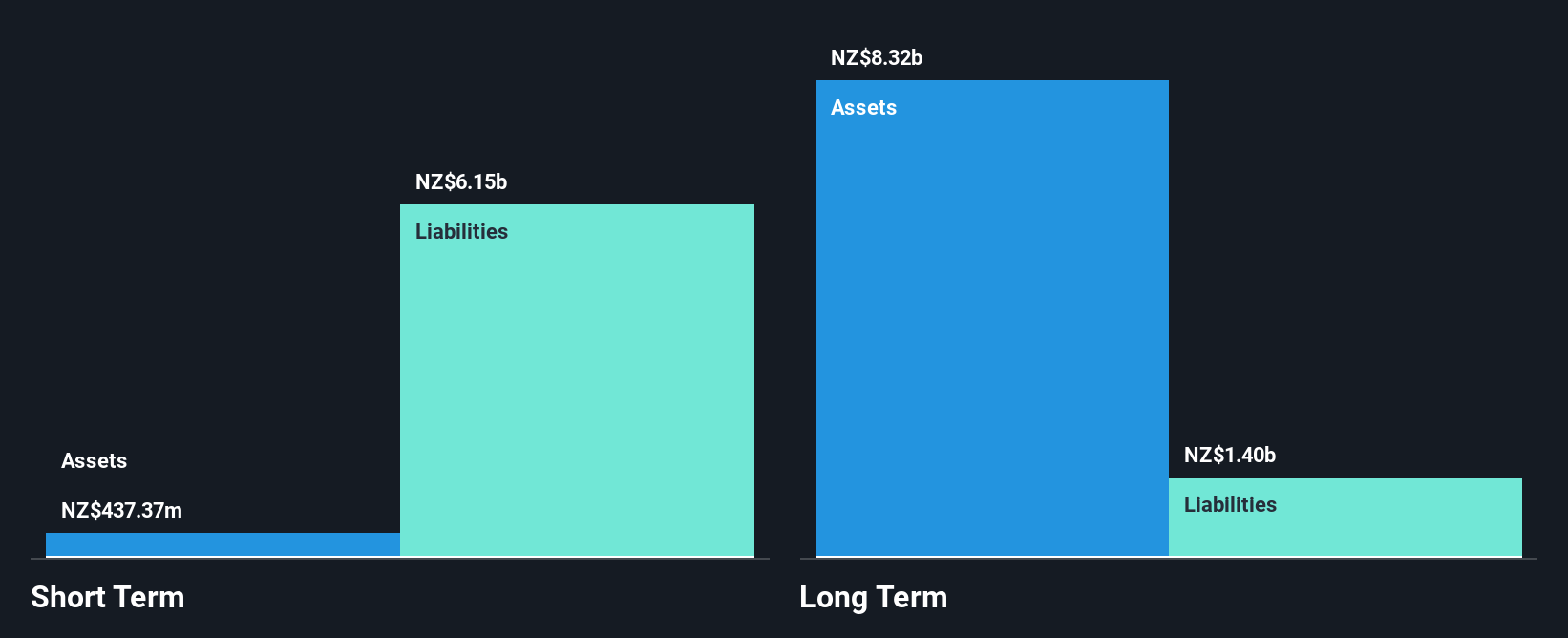

Heartland Group Holdings, with a market cap of NZ$770.88 million, operates primarily in New Zealand and Australia. Despite its diverse revenue streams across sectors like Motor (NZ$40.09 million) and Reverse Mortgages (NZ$54.55 million), the company has faced challenges with declining earnings over the past five years at 2.1% annually and negative growth last year (-52.2%). Its Return on Equity is low at 3.3%, while profit margins have decreased from 34.1% to 17.7%. The board's inexperience might impact strategic decisions, but its funding structure remains stable with low-risk customer deposits comprising most liabilities.

- Get an in-depth perspective on Heartland Group Holdings' performance by reading our balance sheet health report here.

- Evaluate Heartland Group Holdings' prospects by accessing our earnings growth report.

Wee Hur Holdings (SGX:E3B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wee Hur Holdings Ltd. is an investment holding company involved in general building and civil engineering construction in Singapore and Australia, with a market cap of SGD422.85 million.

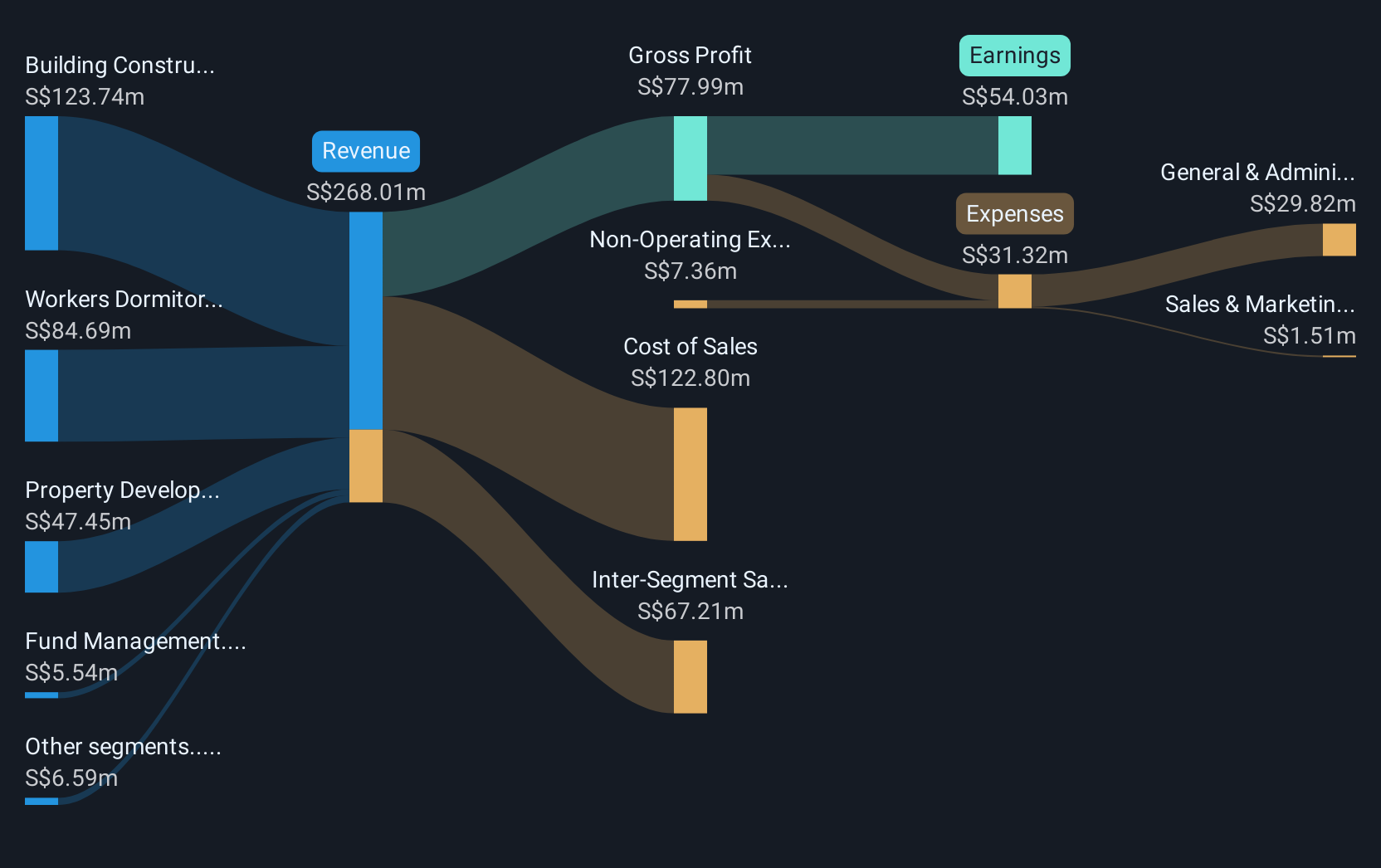

Operations: The company's revenue segments include Building Construction at SGD123.74 million, Workers Dormitory at SGD84.69 million, Corporate Segment at SGD3.56 million, Fund Management at SGD5.54 million, PBSA Operations at SGD2.09 million, Property Development in Singapore at SGD47.45 million, and Property Development in Australia at SGD0.94 million.

Market Cap: SGD422.85M

Wee Hur Holdings, with a market cap of SGD422.85 million, demonstrates a complex financial landscape. The company’s short-term assets (SGD311.8 million) comfortably cover its liabilities, and it maintains a satisfactory net debt to equity ratio of 10.5%. Despite facing negative earnings growth last year and reduced profit margins from 59.6% to 26.9%, its long-term earnings have grown significantly by 26.6% annually over five years, with future growth forecasted at 24.2% per year. Recent developments include filing for SGD500 million in Shelf Registration and announcing a special dividend of SGD0.07 per share pending AGM approval.

- Click here and access our complete financial health analysis report to understand the dynamics of Wee Hur Holdings.

- Examine Wee Hur Holdings' earnings growth report to understand how analysts expect it to perform.

Liuzhou Chemical Industry (SHSE:600423)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Liuzhou Chemical Industry Co., Ltd. is a company that produces and sells hydrogen peroxide in China with a market capitalization of CN¥2.78 billion.

Operations: The company generates revenue of CN¥171.58 million from its chemical industry segment.

Market Cap: CN¥2.78B

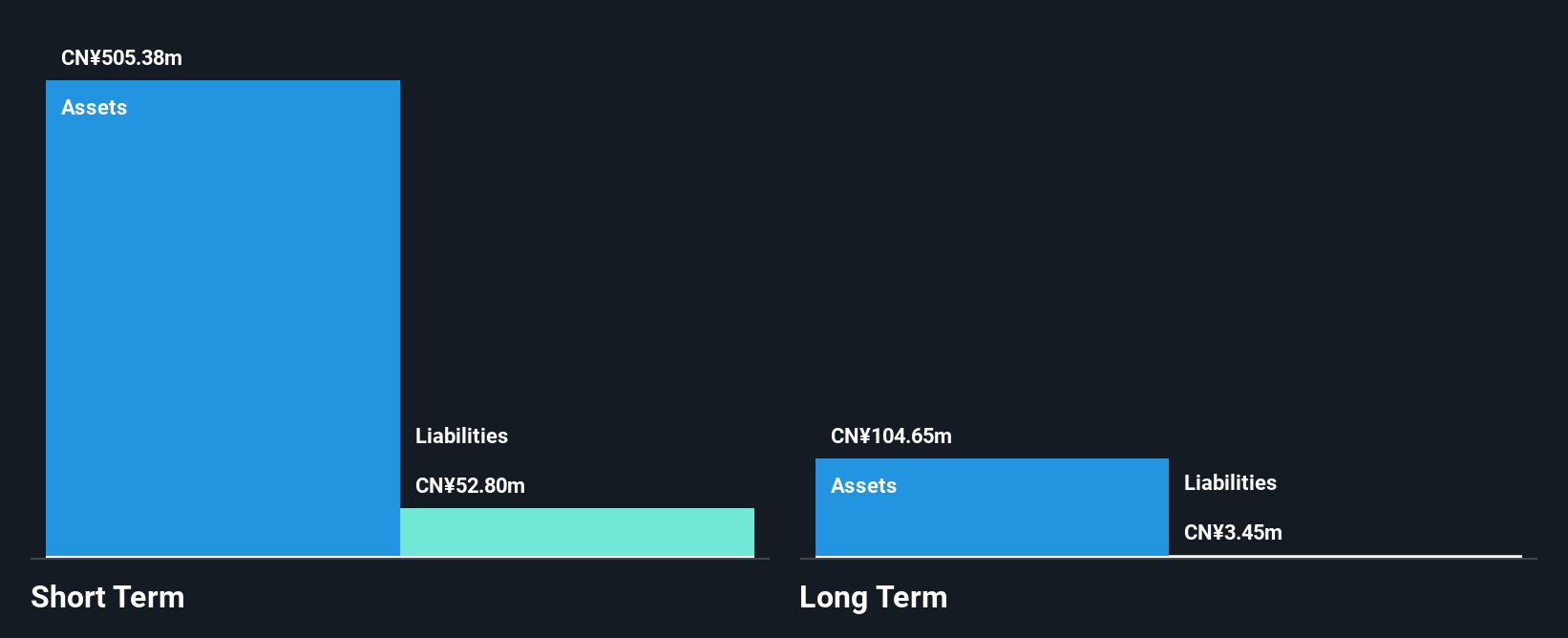

Liuzhou Chemical Industry, with a market cap of CN¥2.78 billion, presents a mixed financial picture. The company's short-term assets of CN¥505.4 million exceed both its short and long-term liabilities, indicating strong liquidity. Despite being debt-free and having high-quality earnings, Liuzhou faced significant challenges last year with net profit margins dropping from 50.9% to 17.4% and negative earnings growth of -59.6%. Recent Q1 results show sales increased to CN¥39.13 million from the previous year, though net income slightly decreased to CN¥2.18 million, reflecting ongoing profitability pressures amidst stable operational conditions.

- Jump into the full analysis health report here for a deeper understanding of Liuzhou Chemical Industry.

- Review our historical performance report to gain insights into Liuzhou Chemical Industry's track record.

Summing It All Up

- Unlock our comprehensive list of 5,620 Global Penny Stocks by clicking here.

- Contemplating Other Strategies? Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heartland Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:HGH

Heartland Group Holdings

Provides various financial services in New Zealand and Australia.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives