- Canada

- /

- Real Estate

- /

- TSX:GDC

Genesis Land Development And 2 Other TSX Penny Stocks To Watch

Reviewed by Simply Wall St

The Canadian market is currently navigating a landscape marked by trade developments, central bank meetings, and fiscal debates, all of which contribute to an atmosphere of resilience tempered by potential volatility. Amid these conditions, investors are exploring various avenues for growth, including the often-overlooked realm of penny stocks. Although the term 'penny stock' might seem outdated, it still signifies opportunities within smaller or newer companies that can offer substantial returns when supported by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.67 | CA$594.7M | ✅ 3 ⚠️ 3 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.33 | CA$722.21M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.58 | CA$190.97M | ✅ 4 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.46M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.74 | CA$459.06M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.87 | CA$14.86M | ✅ 2 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.28 | CA$101.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.45 | CA$141.24M | ✅ 3 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$173.06M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.95 | CA$5.02M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 874 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Genesis Land Development (TSX:GDC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Genesis Land Development Corp., with a market cap of CA$178.11 million, is an integrated land developer and residential home builder that owns and develops residential lands and serviced lots in the Calgary Metropolitan Area, Canada.

Operations: The company generates revenue primarily through its Home Building segment, which accounts for CA$251.89 million.

Market Cap: CA$178.11M

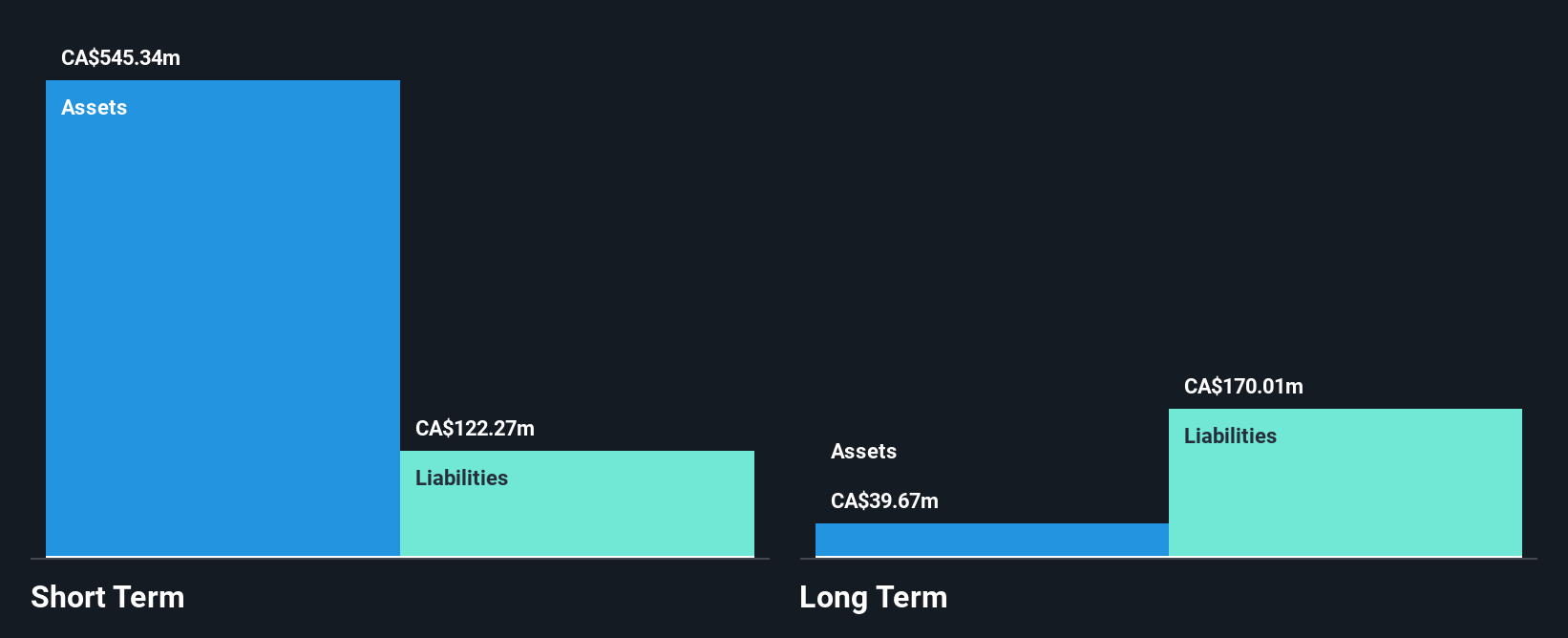

Genesis Land Development Corp. has demonstrated robust earnings growth, with a notable 81.6% increase over the past year, surpassing industry averages. Despite a low return on equity of 14.6%, the company maintains high-quality earnings and strong asset coverage for both short and long-term liabilities. Recent executive changes see Parveshindera Sidhu stepping in as CEO, potentially bringing new strategic directions. While its debt-to-equity ratio has increased over five years to 48.2%, interest payments remain well-covered by EBIT at 13.7 times coverage, though operating cash flow does not adequately cover debt levels, posing some financial risk considerations for investors.

- Dive into the specifics of Genesis Land Development here with our thorough balance sheet health report.

- Learn about Genesis Land Development's historical performance here.

Arrow Exploration (TSXV:AXL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Arrow Exploration Corp. is a junior oil and gas company focused on acquiring, exploring, developing, and producing oil and gas properties in Colombia and Western Canada, with a market cap of CA$87.19 million.

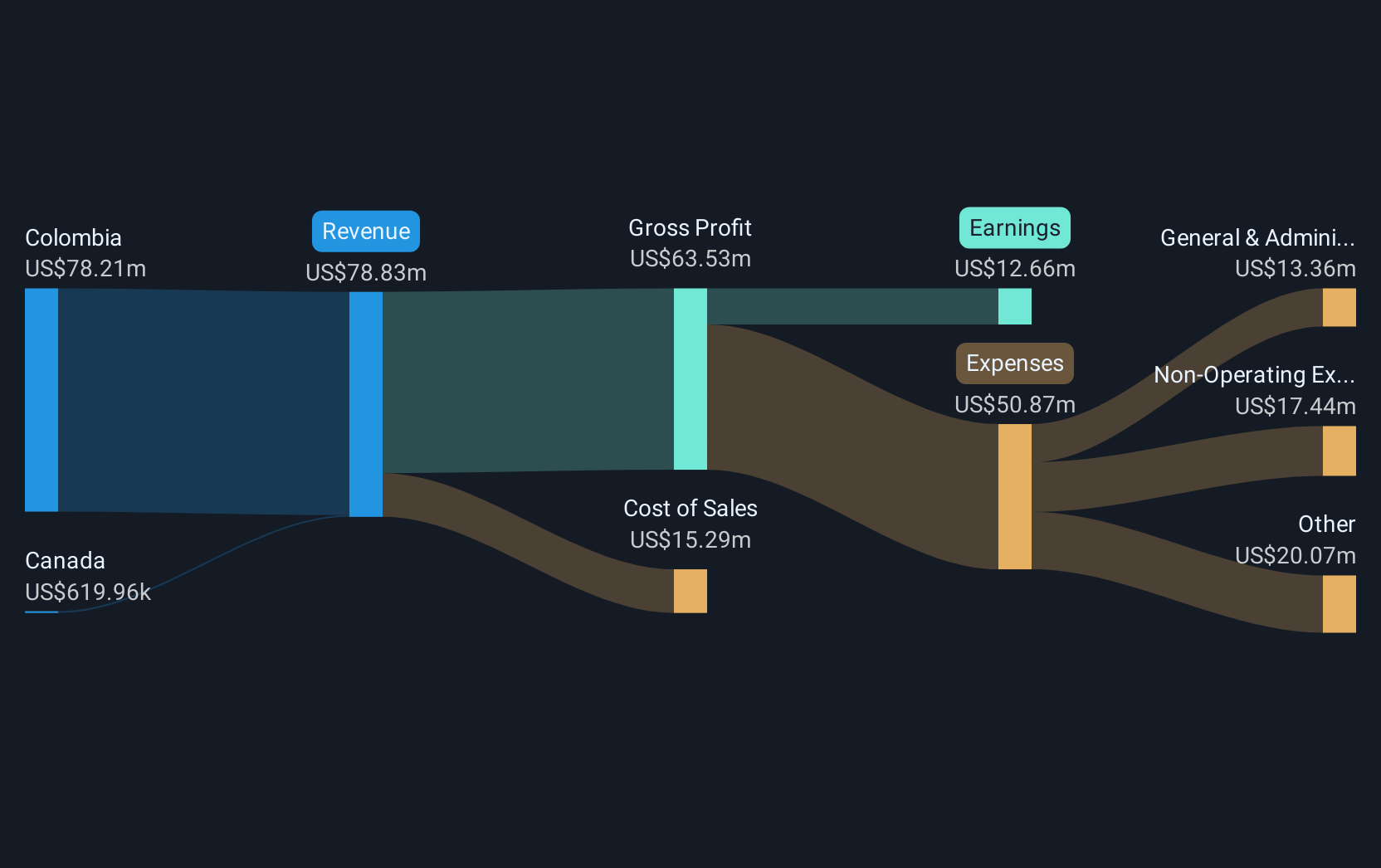

Operations: The company generates revenue of $78.83 million from its oil and gas exploration and production activities.

Market Cap: CA$87.19M

Arrow Exploration Corp. has transitioned to profitability, with a strong revenue increase to US$73.73 million in 2024 from US$44.67 million the previous year and net income reaching US$13.18 million after a prior loss. The company benefits from high-quality earnings, robust asset coverage for liabilities, and no debt burden, enhancing its financial stability amid market volatility. Recent operational updates highlight increased oil production and strategic flexibility in drilling activities on the Tapir Block in Colombia, supported by a cash balance of US$25.1 million and no long-term obligations, positioning Arrow well for sustained cash generation despite fluctuating oil prices.

- Navigate through the intricacies of Arrow Exploration with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Arrow Exploration's future.

GMV Minerals (TSXV:GMV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GMV Minerals Inc. is an exploration stage company focused on sourcing and exploring mineral properties in the United States, with a market cap of CA$18.19 million.

Operations: GMV Minerals Inc. does not report any distinct revenue segments as it is currently in the exploration stage without active production or sales.

Market Cap: CA$18.19M

GMV Minerals Inc., with a market cap of CA$18.19 million, remains in the exploration stage and is pre-revenue, reporting no significant income streams. Despite its unprofitability, GMV has reduced losses over the past five years at a rate of 3.8% annually and recently reported decreased quarterly losses compared to last year. The company is debt-free and successfully raised CA$675,000 through a private placement in April 2025 to support operations. Its seasoned management team averages 16.3 years of tenure, providing stability amid high share price volatility and limited cash runway challenges.

- Take a closer look at GMV Minerals' potential here in our financial health report.

- Gain insights into GMV Minerals' past trends and performance with our report on the company's historical track record.

Summing It All Up

- Click here to access our complete index of 874 TSX Penny Stocks.

- Ready For A Different Approach? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GDC

Genesis Land Development

An integrated land developer and residential home builder, owns and develops residential lands and serviced lots in the Calgary Metropolitan Area, Canada.

Solid track record and good value.

Market Insights

Community Narratives