Amid renewed uncertainty about U.S. trade policy and escalating geopolitical tensions in the Middle East, European markets have experienced a downturn, with major indexes such as Germany’s DAX and Italy’s FTSE MIB seeing significant declines. In this environment of fluctuating market sentiment, identifying undervalued stocks can be particularly appealing to investors seeking opportunities that may offer potential value relative to their current trading prices.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VIGO Photonics (WSE:VGO) | PLN518.00 | PLN1021.40 | 49.3% |

| TTS (Transport Trade Services) (BVB:TTS) | RON4.325 | RON8.46 | 48.9% |

| Sparebank 68° Nord (OB:SB68) | NOK183.40 | NOK364.91 | 49.7% |

| Qt Group Oyj (HLSE:QTCOM) | €55.45 | €107.99 | 48.7% |

| Lectra (ENXTPA:LSS) | €23.80 | €46.62 | 49% |

| Koskisen Oyj (HLSE:KOSKI) | €8.78 | €17.36 | 49.4% |

| Just Eat Takeaway.com (ENXTAM:TKWY) | €19.50 | €38.97 | 50% |

| dormakaba Holding (SWX:DOKA) | CHF705.00 | CHF1399.39 | 49.6% |

| CTT Systems (OM:CTT) | SEK208.00 | SEK408.94 | 49.1% |

| ABO Energy GmbH KGaA (XTRA:AB9) | €36.30 | €71.39 | 49.2% |

Here we highlight a subset of our preferred stocks from the screener.

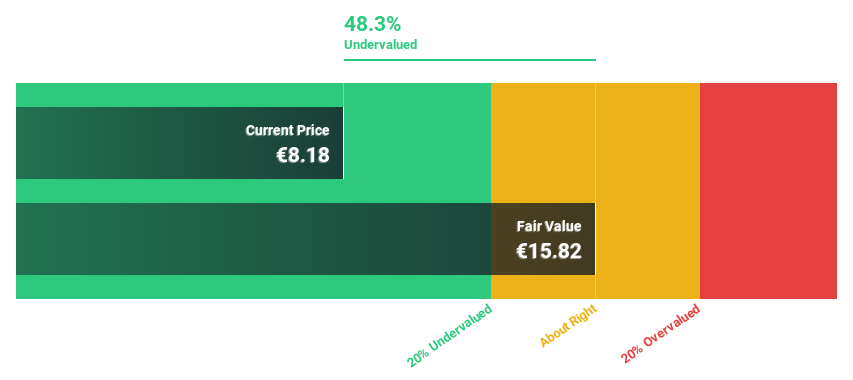

Tinexta (BIT:TNXT)

Overview: Tinexta S.p.A., along with its subsidiaries, offers digital trust, cybersecurity, and business innovation services across various regions including Italy, France, Spain, the rest of the EU, the United Kingdom, the UAE and internationally with a market cap of €487.37 million.

Operations: The company's revenue is derived from three main segments: Cybersecurity (€114.29 million), Digital Trust (€210.01 million), and Business Innovation (€158.11 million).

Estimated Discount To Fair Value: 15.9%

Tinexta is currently trading at €10.62, below its estimated fair value of €12.63, suggesting it may be undervalued based on cash flows. Despite a high level of debt and unstable dividend history, earnings are forecast to grow significantly by 29.57% annually over the next three years, outpacing the Italian market's growth rate. Recent earnings showed improvement with a reduced net loss of €3.15 million for Q1 2025 compared to last year’s figures.

- Our comprehensive growth report raises the possibility that Tinexta is poised for substantial financial growth.

- Get an in-depth perspective on Tinexta's balance sheet by reading our health report here.

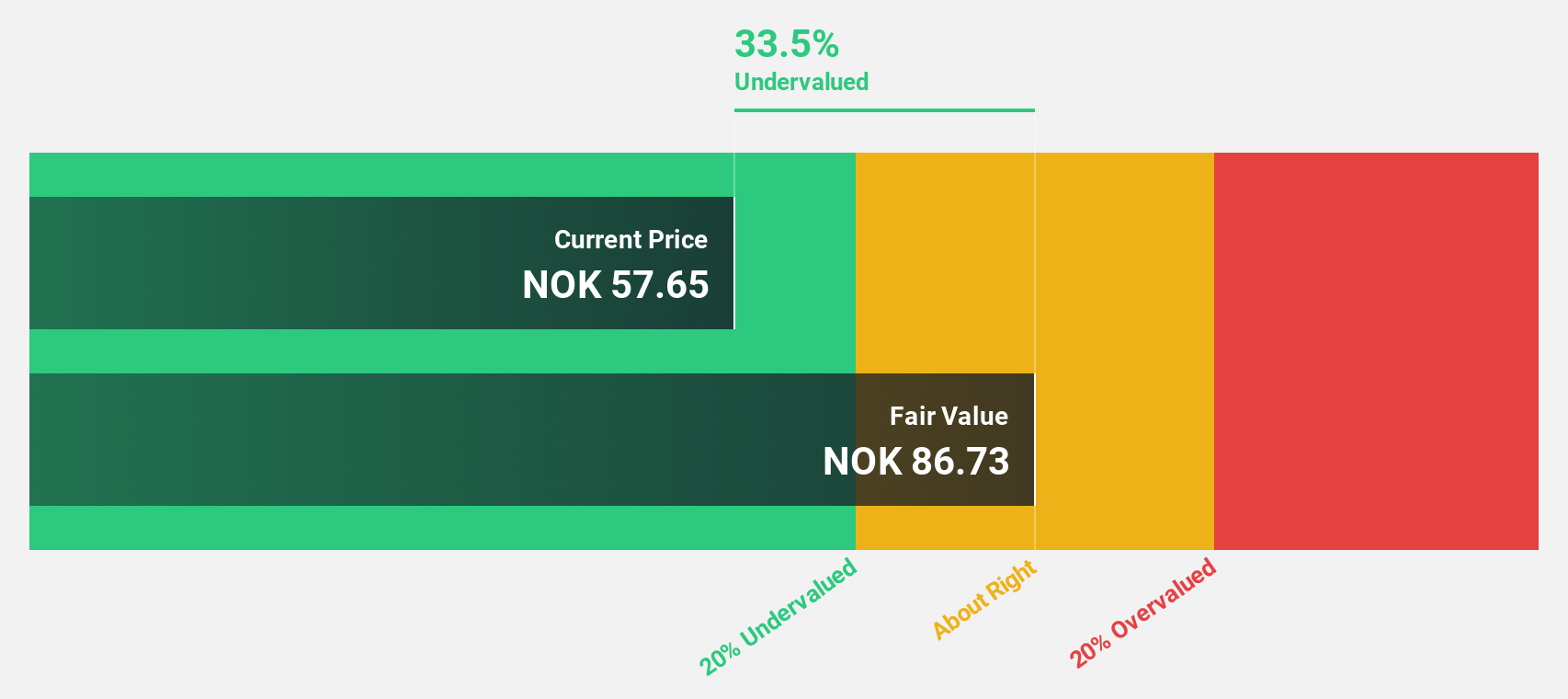

Kitron (OB:KIT)

Overview: Kitron ASA is an electronics manufacturing services provider operating in multiple countries, including Norway, Sweden, and the United States, with a market cap of NOK11.37 billion.

Operations: The company generates revenue of €637.90 million from its Electronics Manufacturing Services (EMS) segment.

Estimated Discount To Fair Value: 33.5%

Kitron is trading at NOK 57.15, below its estimated fair value of NOK 85.96, highlighting potential undervaluation based on cash flows. Despite high debt levels, Kitron's earnings are forecast to grow significantly by over 20% annually, outpacing the Norwegian market. Recent agreements with industrial and U.S.-based clients for electronics manufacturing services underscore strategic growth in key sectors. Q1 2025 earnings showed improved net income of EUR 7.6 million compared to last year’s figures.

- Our growth report here indicates Kitron may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Kitron stock in this financial health report.

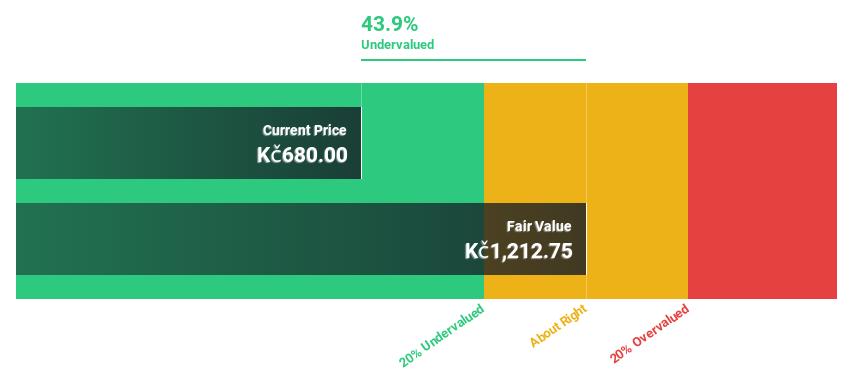

Colt CZ Group (SEP:CZG)

Overview: Colt CZ Group SE, along with its subsidiaries, is involved in the production and sale of firearms, ammunition products, and tactical accessories across various regions including the Czech Republic, Canada, the United States, Europe, Africa, Asia and other international markets; it has a market cap of CZK41.22 billion.

Operations: The company's revenue primarily comes from its Firearms and Accessories segment, which generated CZK17.60 billion.

Estimated Discount To Fair Value: 27.6%

Colt CZ Group, trading at CZK 730, is valued below its estimated fair value of CZK 1008.84, indicating potential undervaluation based on cash flows. Despite a high debt level and recent shareholder dilution, earnings are forecast to grow significantly by over 20% annually, surpassing the Czech market's growth rate. Q1 2025 results showed strong performance with net income rising to CZK 523.91 million from the previous year's figures, although profit margins have decreased compared to last year.

- Our expertly prepared growth report on Colt CZ Group implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Colt CZ Group with our detailed financial health report.

Summing It All Up

- Reveal the 175 hidden gems among our Undervalued European Stocks Based On Cash Flows screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kitron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:KIT

Kitron

Operates as an electronics manufacturing services provider in Norway, Sweden, Denmark, Lithuania, Germany, Poland, the Czech Republic, India, China, Malaysia, and the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives