European Penny Stocks: Alumil Rom Industry And 2 More Compelling Picks

Reviewed by Simply Wall St

European markets have recently faced challenges, with the pan-European STOXX Europe 600 Index dipping due to geopolitical tensions and economic uncertainties. Despite these fluctuations, certain investment opportunities continue to attract attention, particularly in the realm of penny stocks. Though often seen as a niche area, penny stocks can present growth potential for investors willing to explore smaller or newer companies with strong financial foundations.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.50 | €79.91M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.69 | SEK276.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.75 | €58M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.63 | €17.31M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN11.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Libertas 7 (BME:LIB) | €2.02 | €43.04M | ✅ 3 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.42 | SEK2.32B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.62 | SEK220.24M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.08 | €287.17M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.972 | €32.78M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 327 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Alumil Rom Industry (BVB:ALU)

Simply Wall St Financial Health Rating: ★★★★★☆

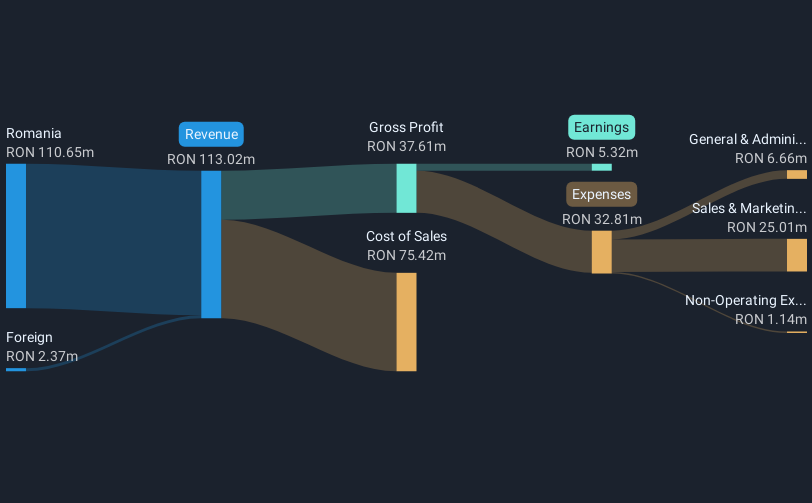

Overview: Alumil Rom Industry S.A. specializes in the design and production of architectural aluminium systems, serving both the Romanian and international markets, with a market cap of RON94.06 million.

Operations: The company generates revenue primarily from its Aluminum Profiles and Accessories and Tools segment, totaling RON114.14 million.

Market Cap: RON94.06M

Alumil Rom Industry's recent financial results show modest revenue growth, with first-quarter sales increasing to RON 24.92 million from RON 23.8 million the previous year, though net income slightly decreased to RON 1.07 million. The company's debt is well managed, with operating cash flow covering debt by a significant margin and short-term assets exceeding both short- and long-term liabilities comfortably. Despite a low return on equity of 7.3%, earnings are considered high quality, and interest payments are well covered by EBIT at 14.9 times coverage, although profit margins have declined slightly over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Alumil Rom Industry.

- Examine Alumil Rom Industry's past performance report to understand how it has performed in prior years.

bet-at-home.com (XTRA:ACX)

Simply Wall St Financial Health Rating: ★★★★☆☆

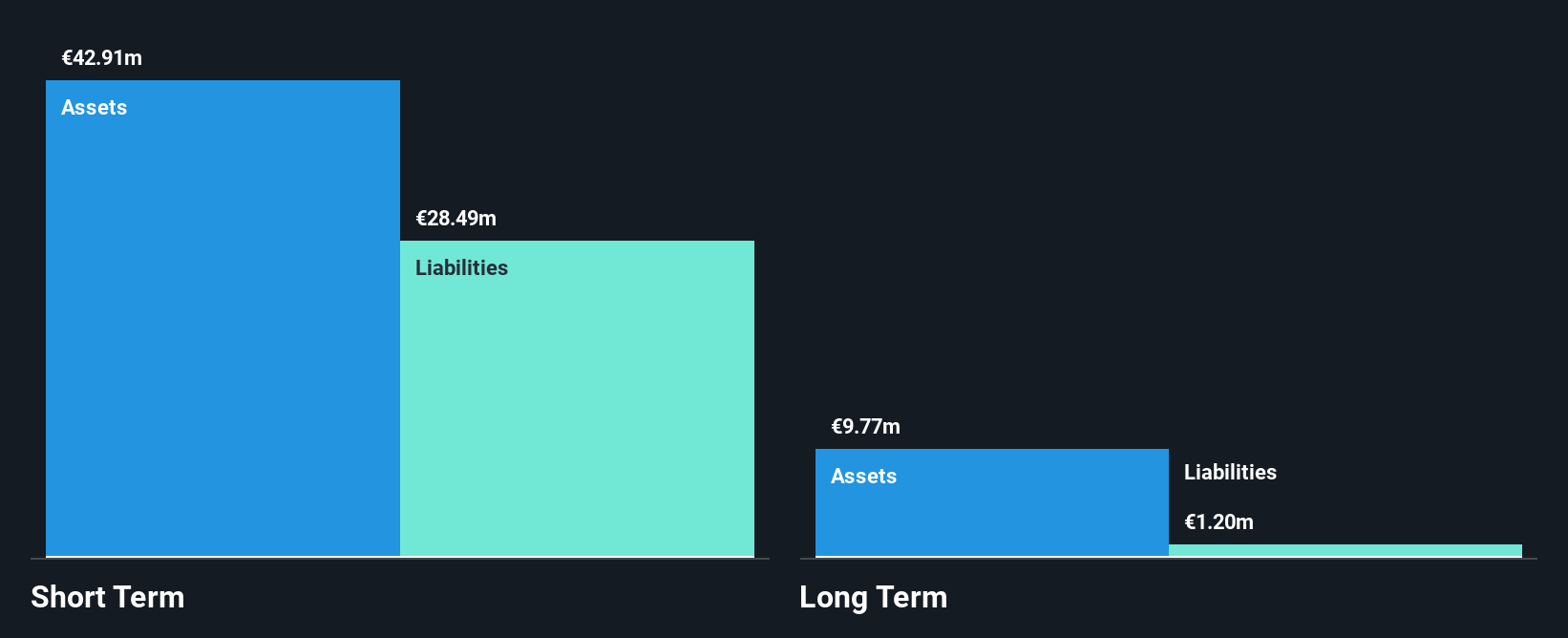

Overview: bet-at-home.com AG, with a market cap of €21.12 million, operates through its subsidiaries to offer online sports betting and gaming services.

Operations: The company's revenue is primarily derived from online sports bets, which account for €47.48 million, and online gaming activities, including casino, poker, games, and virtual sports, contributing €6.20 million.

Market Cap: €21.12M

bet-at-home.com AG, with a market cap of €21.12 million, shows mixed financial health as it navigates the penny stock landscape. The company's short-term assets (€42.9M) surpass both its short- and long-term liabilities, indicating solid liquidity. However, despite revenue growth to €52.3 million in 2024 from €46.18 million previously, it reported a net loss of €4.45 million for the year, highlighting profitability challenges amid increasing losses over five years at 66.4% annually. Recent leadership changes may impact strategic direction as Claus Retschitzegger assumes the management board role following Marco Falchetto's resignation effective May 31, 2025.

- Unlock comprehensive insights into our analysis of bet-at-home.com stock in this financial health report.

- Explore bet-at-home.com's analyst forecasts in our growth report.

elumeo (XTRA:ELB)

Simply Wall St Financial Health Rating: ★★★★☆☆

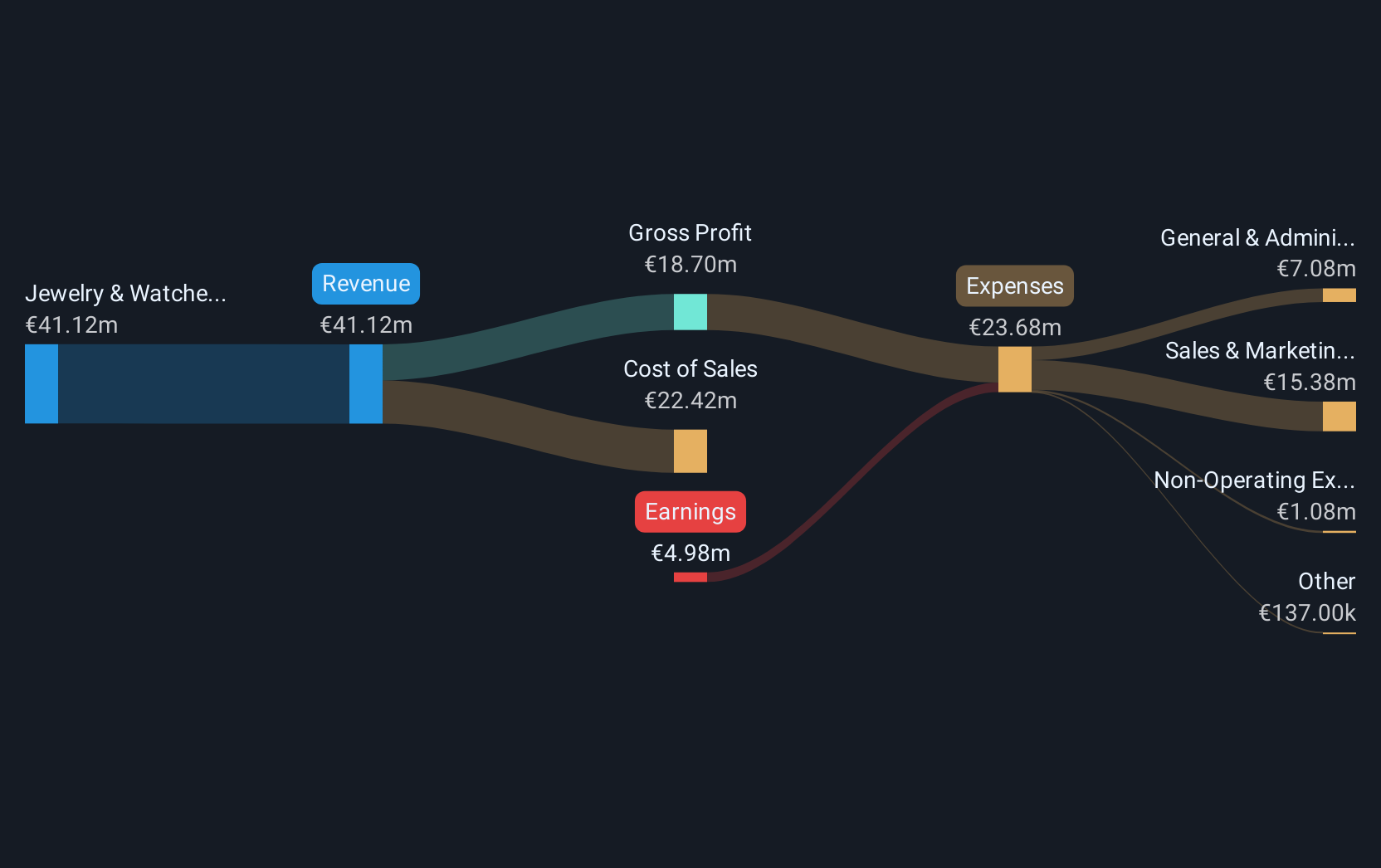

Overview: elumeo SE, with a market cap of €13.51 million, operates through its subsidiaries in the design, procurement, and distribution of gemstone jewelry.

Operations: The company generates revenue primarily from its Jewelry & Watches segment, which accounts for €43.39 million.

Market Cap: €13.51M

elumeo SE, with a market cap of €13.51 million, is navigating challenges typical of penny stocks. Despite generating €43.39 million in revenue primarily from its Jewelry & Watches segment, the company remains unprofitable with an increasing net loss of €4.42 million in 2024 compared to the previous year. Recent strategic adjustments include reducing live broadcasting hours and cutting nearly 50 full-time positions to manage costs effectively, resulting in decreased total costs for Q1 2025 and increased average turnover per jewelry piece sold. The management team is experienced with a satisfactory net debt to equity ratio of 10.2%.

- Take a closer look at elumeo's potential here in our financial health report.

- Gain insights into elumeo's future direction by reviewing our growth report.

Where To Now?

- Get an in-depth perspective on all 327 European Penny Stocks by using our screener here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ELB

elumeo

Through its subsidiaries, engages in the design, procurement, and distribution of gemstone jewelry.

Excellent balance sheet and good value.

Market Insights

Community Narratives