- France

- /

- Electric Utilities

- /

- ENXTPA:ELEC

European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

Amid renewed uncertainty about U.S. trade policy and escalating geopolitical tensions in the Middle East, European markets have experienced a downturn, with the pan-European STOXX Europe 600 Index ending 1.57% lower recently. Despite these challenges, dividend stocks can offer stability and income potential to investors seeking to enhance their portfolios during volatile periods.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.58% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.99% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.35% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.45% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 5.03% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.84% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 3.90% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.23% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.56% | ★★★★★★ |

Click here to see the full list of 239 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

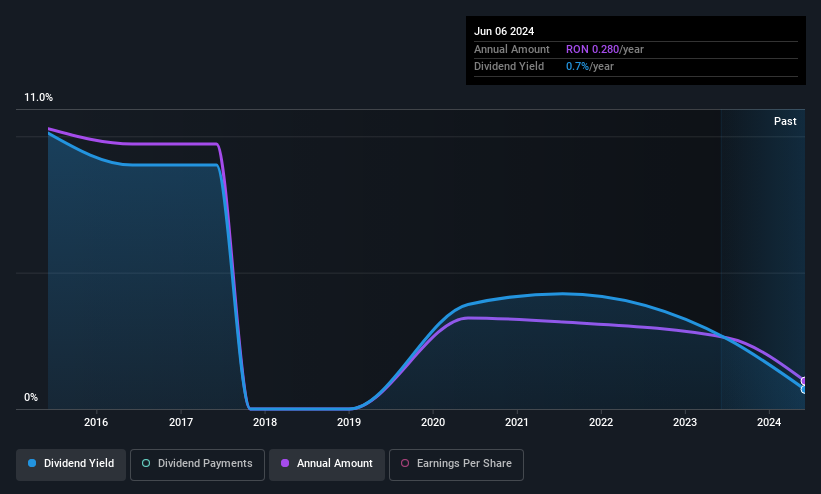

CNTEE Transelectrica (BVB:TEL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CNTEE Transelectrica SA operates as a transmission and system operator for the national power system, with a market cap of RON3.85 billion.

Operations: CNTEE Transelectrica SA generates revenue primarily through its Transmission and Dispatch segment, which accounted for RON7.33 billion.

Dividend Yield: 7.3%

CNTEE Transelectrica's dividend payments have been volatile over the past decade, yet they are well-covered by earnings (payout ratio: 44.4%) and cash flows (cash payout ratio: 66%). Despite this instability, recent announcements indicate an annual dividend increase to RON 3.81 per share. The company's earnings surged by 163.1% year-over-year, with Q1 net income rising to RON 153.21 million from RON 103.86 million a year ago, supporting its top-tier dividend yield of 7.26%.

- Click to explore a detailed breakdown of our findings in CNTEE Transelectrica's dividend report.

- Our comprehensive valuation report raises the possibility that CNTEE Transelectrica is priced lower than what may be justified by its financials.

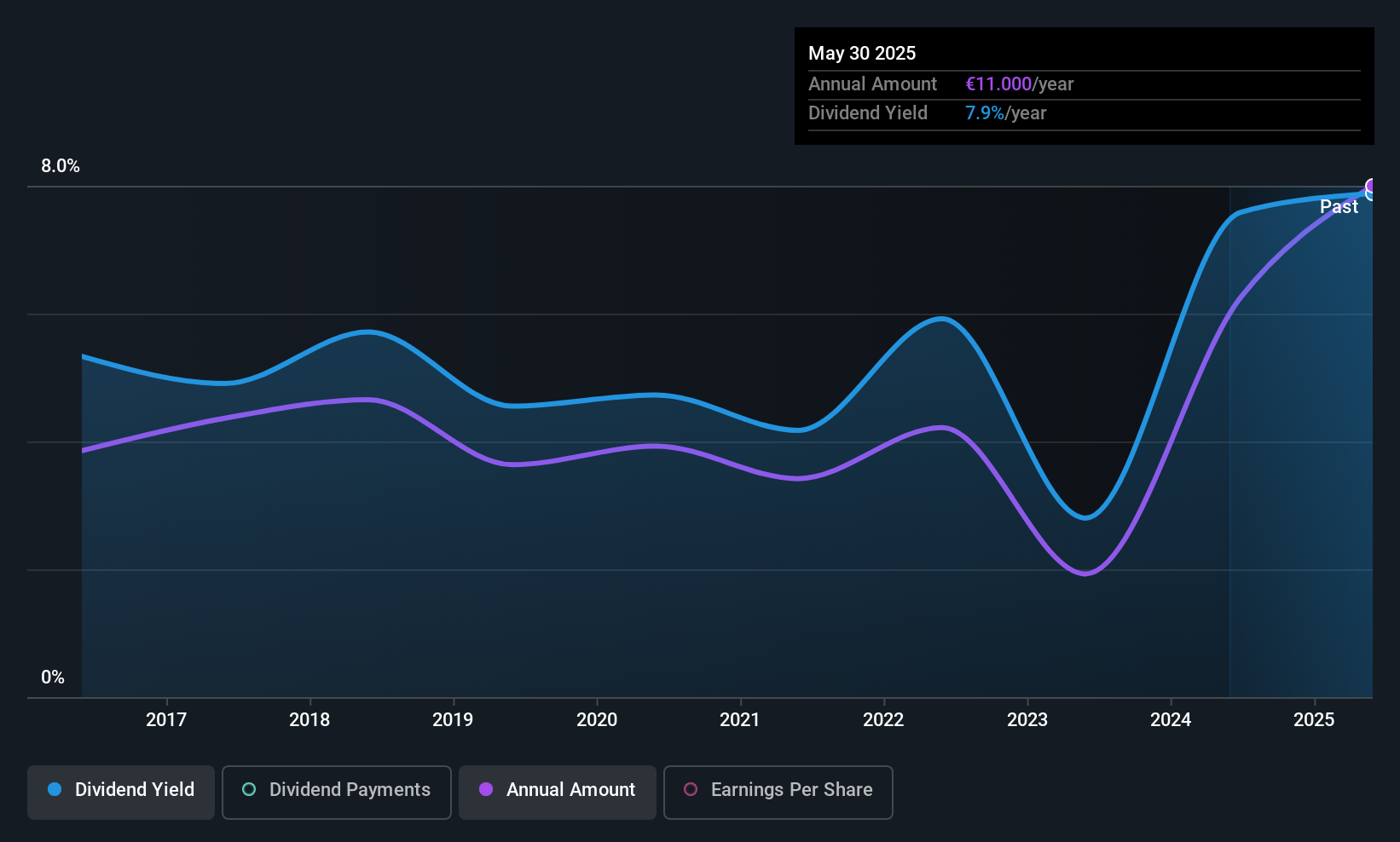

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme supplies electricity and natural gas to individuals, businesses, and local authorities in France, with a market cap of €1.04 billion.

Operations: Électricite de Strasbourg Société Anonyme generates revenue primarily from the production and marketing of electricity and gas (€1.12 billion), along with the consumption of electricity and gas (€311.39 million).

Dividend Yield: 7.6%

Électricite de Strasbourg Société Anonyme's dividend payments have been volatile and unreliable over the past decade, yet they are supported by a reasonable payout ratio of 52.4% and cash payout ratio of 71%. Despite this instability, dividends have grown over the last ten years. The company offers a top-tier dividend yield of 7.61%, outperforming the French market average. Recent earnings show net income rose to €150.42 million from €93.36 million year-over-year, indicating strong financial performance despite declining sales and revenue figures.

- Click here to discover the nuances of Électricite de Strasbourg Société Anonyme with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Électricite de Strasbourg Société Anonyme is trading behind its estimated value.

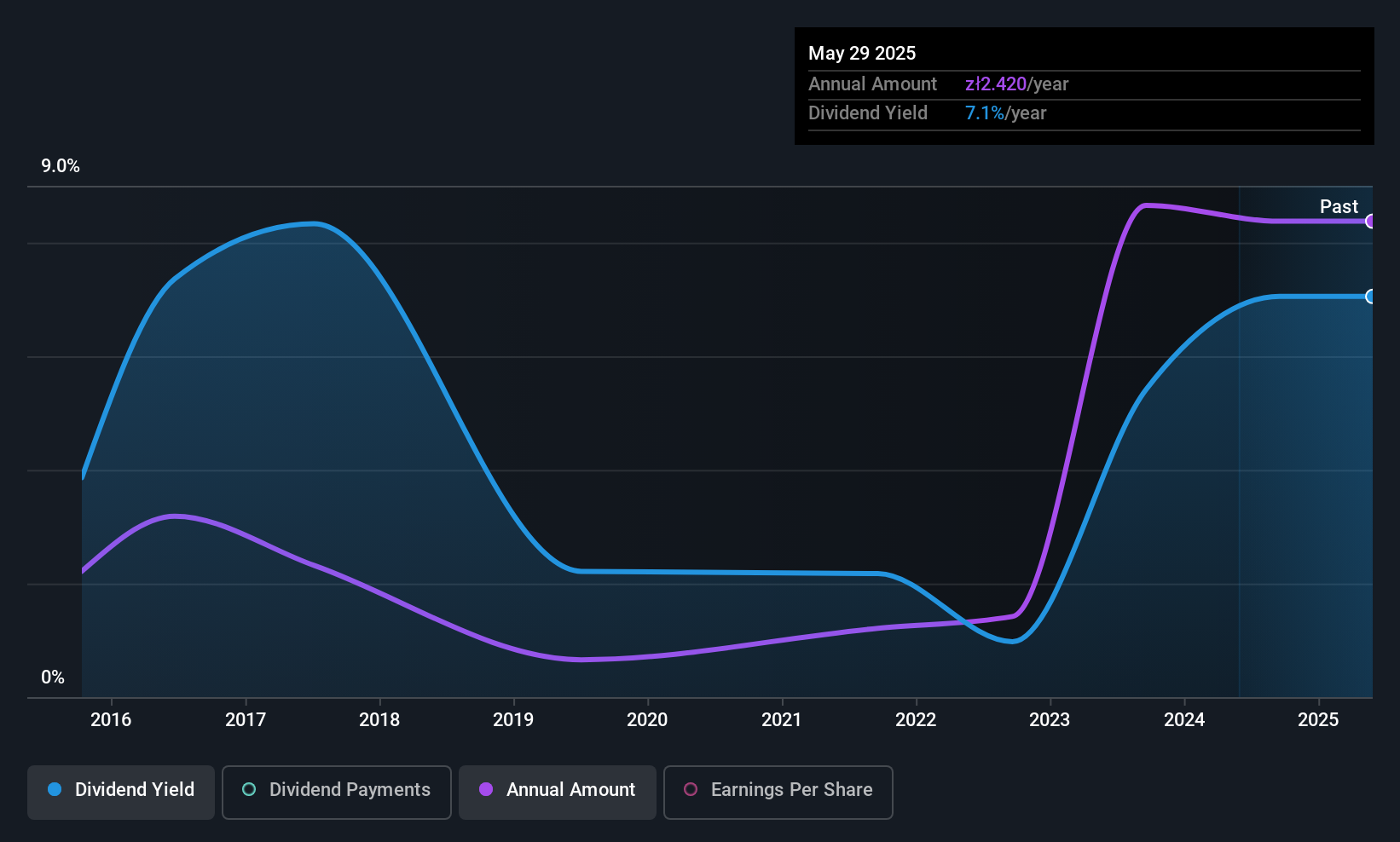

Votum (WSE:VOT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Votum S.A. assists road accident victims in securing compensation from insurance companies and has a market cap of PLN531 million.

Operations: Votum S.A.'s revenue segments include Bank Claims at PLN535.50 million, Rehabilitation at PLN31.80 million, and Compensation Cases at PLN49.31 million.

Dividend Yield: 5.5%

Votum's dividend yield of 5.47% is below the top tier in Poland, yet its dividends are well-covered by earnings and cash flows, with payout ratios of 28.6% and 20.6%, respectively. Despite a history of volatility and unreliability in dividend payments, they have grown over the past decade. Recent Q1 results show strong financial performance with net income rising to PLN 43.56 million from PLN 20.16 million year-over-year, supporting potential future payouts.

- Get an in-depth perspective on Votum's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Votum shares in the market.

Turning Ideas Into Actions

- Take a closer look at our Top European Dividend Stocks list of 239 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Électricite de Strasbourg Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ELEC

Électricite de Strasbourg Société Anonyme

Engages in the supply of electricity and natural gas to individuals, businesses, and local authorities in France.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives