- United States

- /

- Biotech

- /

- NasdaqCM:PIRS

Earnings Beat: Pieris Pharmaceuticals, Inc. Just Beat Analyst Forecasts, And Analysts Have Been Lifting Their Forecasts

One of the biggest stories of last week was how Pieris Pharmaceuticals, Inc. (NASDAQ:PIRS) shares plunged 26% in the week since its latest yearly results, closing yesterday at US$2.16. Revenues of US$46m crushed expectations, although expenses also blew out, with the company reporting a statutory loss per share of US$0.56, 26% bigger than analysts expected. Analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we gathered the latest post-earnings forecasts to see what analysts' statutory forecasts suggest is in store for next year.

See our latest analysis for Pieris Pharmaceuticals

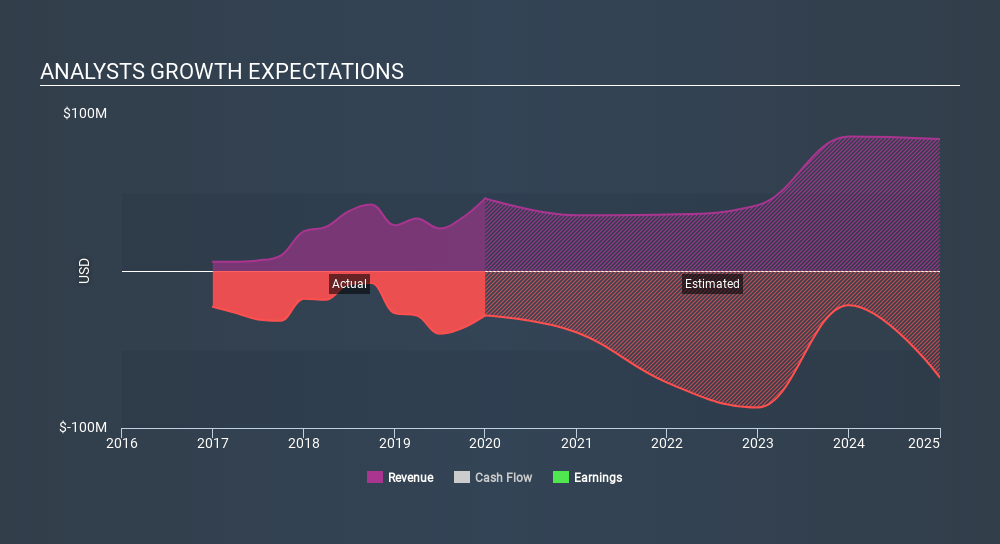

After the latest results, the consensus from Pieris Pharmaceuticals's five analysts is for revenues of US$35.5m in 2020, which would reflect a stressful 23% decline in sales compared to the last year of performance. Losses are predicted to fall substantially, shrinking 27% (on a statutory basis) to US$0.71. Before this earnings announcement, analysts had been forecasting revenues of US$31.1m and losses of US$0.89 per share in 2020. So we can see there's been a pretty clear increase in analyst sentiment following the latest results, with both revenues and earnings per share receiving a decent lift in the latest estimates.

It will come as no surprise to learn that analysts have increased their price target for Pieris Pharmaceuticals 9.1% to US$8.00 on the back of these upgrades. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Pieris Pharmaceuticals analyst has a price target of US$10.00 per share, while the most pessimistic values it at US$5.00. This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

Further, we can compare these estimates to past performance, and see how Pieris Pharmaceuticals forecasts compare to the wider market's forecast performance. We would highlight that sales are expected to reverse, with the forecast 23% revenue decline a notable change from historical growth of 50% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same market are forecast to see their revenue grow 16% annually for the foreseeable future. It's pretty clear that Pieris Pharmaceuticals's revenues are expected to perform substantially worse than the wider market.

The Bottom Line

The most important thing to note from these estimates is that the consensus increased its forecast losses next year, suggesting all may not be well at Pieris Pharmaceuticals. They also upgraded their revenue estimates for next year, even though sales are expected to grow slower than the wider market. Analysts also upgraded their price target, suggesting that analysts believe the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Pieris Pharmaceuticals analysts - going out to 2024, and you can see them free on our platform here.

You can also see our analysis of Pieris Pharmaceuticals's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:PIRS

Pieris Pharmaceuticals

A biotechnology company, discovers and develops biotechnological applications.

Adequate balance sheet slight.

Market Insights

Community Narratives