Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Zhongyu Gas Holdings Limited (HKG:3633) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Zhongyu Gas Holdings

What Is Zhongyu Gas Holdings's Debt?

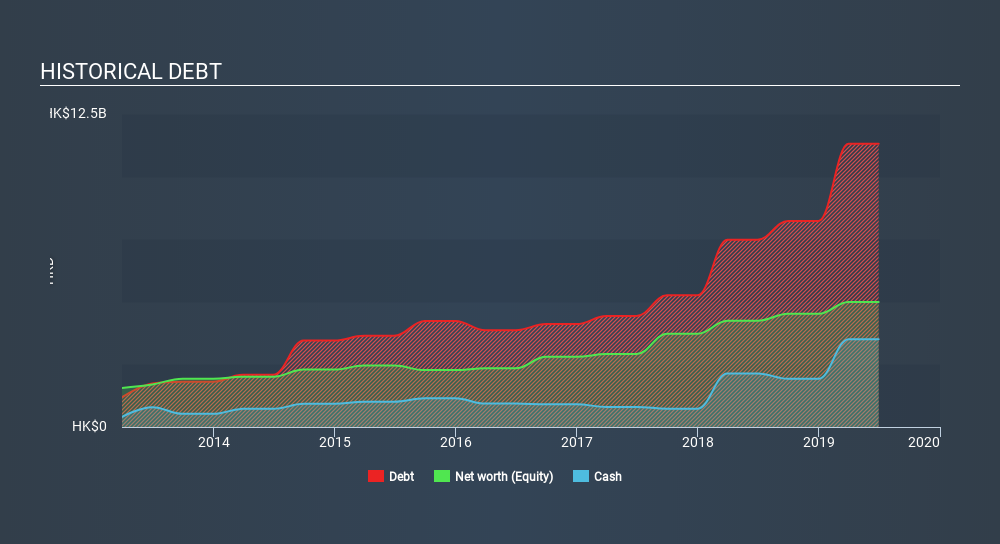

The image below, which you can click on for greater detail, shows that at June 2019 Zhongyu Gas Holdings had debt of HK$11.3b, up from HK$7.48b in one year. However, it does have HK$3.51b in cash offsetting this, leading to net debt of about HK$7.80b.

How Strong Is Zhongyu Gas Holdings's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Zhongyu Gas Holdings had liabilities of HK$6.06b due within 12 months and liabilities of HK$8.56b due beyond that. On the other hand, it had cash of HK$3.51b and HK$2.47b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$8.65b.

While this might seem like a lot, it is not so bad since Zhongyu Gas Holdings has a market capitalization of HK$18.3b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Zhongyu Gas Holdings has a debt to EBITDA ratio of 4.1 and its EBIT covered its interest expense 6.3 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Zhongyu Gas Holdings grew its EBIT by 6.5% in the last year. That's far from incredible but it is a good thing, when it comes to paying off debt. There's no doubt that we learn most about debt from the balance sheet. But it is Zhongyu Gas Holdings's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Zhongyu Gas Holdings saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Zhongyu Gas Holdings's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered cast it in a significantly better light. But on the bright side, its ability to to grow its EBIT isn't too shabby at all. We should also note that Gas Utilities industry companies like Zhongyu Gas Holdings commonly do use debt without problems. When we consider all the factors discussed, it seems to us that Zhongyu Gas Holdings is taking some risks with its use of debt. While that debt can boost returns, we think the company has enough leverage now. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 3 warning signs for Zhongyu Gas Holdings you should be aware of, and 2 of them make us uncomfortable.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:3633

Zhongyu Energy Holdings

An investment holding company, engages in the development, construction, and operation of natural gas projects in the People’s Republic of China.

Low with poor track record.

Market Insights

Community Narratives