- Russia

- /

- Metals and Mining

- /

- MISX:URKZ

Does Urals Stampings Plant PAO (MCX:URKZ) Have A Healthy Balance Sheet?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Urals Stampings Plant PAO (MCX:URKZ) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Urals Stampings Plant PAO

How Much Debt Does Urals Stampings Plant PAO Carry?

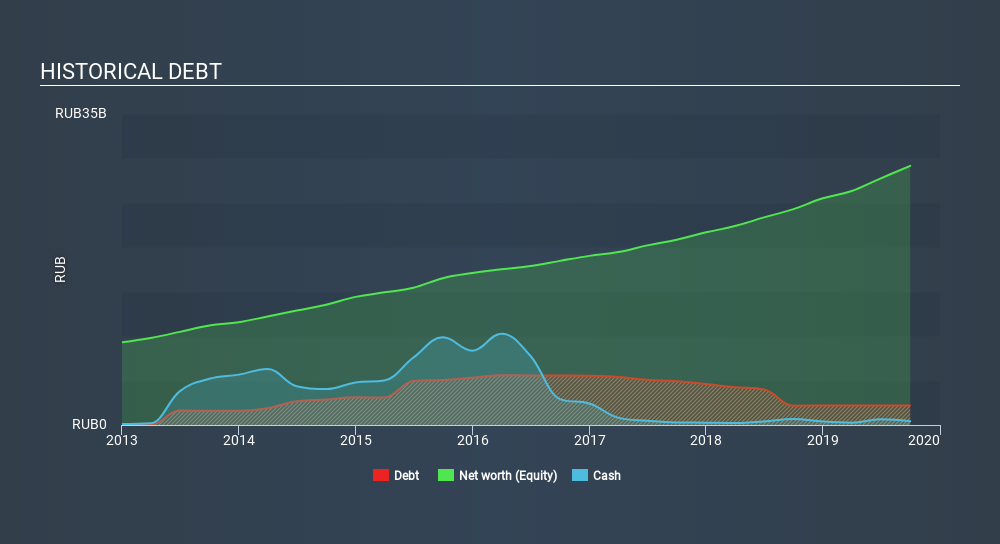

As you can see below, Urals Stampings Plant PAO had ₽2.18b of debt, at September 2019, which is about the same the year before. You can click the chart for greater detail. However, because it has a cash reserve of ₽423.2m, its net debt is less, at about ₽1.76b.

How Healthy Is Urals Stampings Plant PAO's Balance Sheet?

According to the last reported balance sheet, Urals Stampings Plant PAO had liabilities of ₽1.85b due within 12 months, and liabilities of ₽2.20b due beyond 12 months. Offsetting these obligations, it had cash of ₽423.2m as well as receivables valued at ₽8.85b due within 12 months. So it can boast ₽5.23b more liquid assets than total liabilities.

This luscious liquidity implies that Urals Stampings Plant PAO's balance sheet is sturdy like a giant sequoia tree. On this view, it seems its balance sheet is as strong as a black-belt karate master.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Urals Stampings Plant PAO has a low debt to EBITDA ratio of only 0.77. And remarkably, despite having net debt, it actually received more in interest over the last twelve months than it had to pay. So there's no doubt this company can take on debt while staying cool as a cucumber. Even more impressive was the fact that Urals Stampings Plant PAO grew its EBIT by 201% over twelve months. If maintained that growth will make the debt even more manageable in the years ahead. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Urals Stampings Plant PAO will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Happily for any shareholders, Urals Stampings Plant PAO actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

Urals Stampings Plant PAO's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! After looking at a variety of factors, it's pretty clear to us that Urals Stampings Plant PAO has a very strong balance sheet. We're no more concerned about its debt than sailing off the edge of the earth. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Urals Stampings Plant PAO's earnings per share history for free.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About MISX:URKZ

Urals Stampings Plant PAO

Urals Stampings Plant PAO engages in the production and sale of hot stampings and forgings in Russia.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives