- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TZOO

Does Travelzoo's (NASDAQ:TZOO) CEO Pay Reflect Performance?

In 2016 Holger Bartel was appointed CEO of Travelzoo (NASDAQ:TZOO). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. After that, we will consider the growth in the business. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for Travelzoo

How Does Holger Bartel's Compensation Compare With Similar Sized Companies?

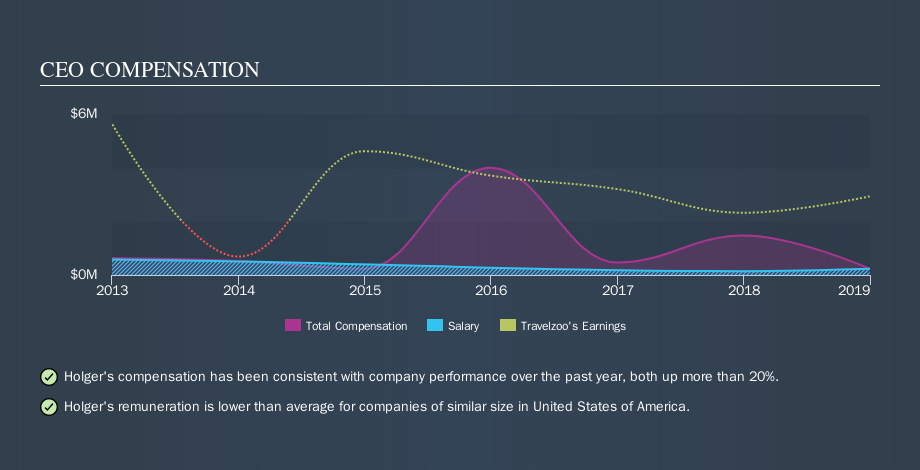

At the time of writing, our data says that Travelzoo has a market cap of US$124m, and reported total annual CEO compensation of US$232k for the year to December 2018. It is worth noting that the CEO compensation consists almost entirely of the salary, worth US$232k. We examined a group of similar sized companies, with market capitalizations of below US$200m. The median CEO total compensation in that group is US$496k.

A first glance this seems like a real positive for shareholders, since Holger Bartel is paid less than the average total compensation paid by similar sized companies. However, before we heap on the praise, we should delve deeper to understand business performance.

You can see a visual representation of the CEO compensation at Travelzoo, below.

Is Travelzoo Growing?

Over the last three years Travelzoo has shrunk its earnings per share by an average of 15% per year (measured with a line of best fit). In the last year, its revenue changed by just 0.7%.

Sadly for shareholders, earnings per share are actually down, over three years. And the flat revenue hardly impresses. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. It could be important to check this free visual depiction of what analysts expect for the future.

Has Travelzoo Been A Good Investment?

Given the total loss of 13% over three years, many shareholders in Travelzoo are probably rather dissatisfied, to say the least. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

It looks like Travelzoo pays its CEO less than similar sized companies.

Holger Bartel is paid less than CEOs of similar size companies, but the company isn't growing and total shareholder returns have been disappointing. Considering all these factors, we'd stop short of saying the CEO pay is too high, but we don't think shareholders would want to see a pay rise before business performance improves. Shareholders may want to check for free if Travelzoo insiders are buying or selling shares.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:TZOO

Travelzoo

Operates as an Internet media company that provides travel, entertainment, and local experiences worldwide.

Undervalued with slight risk.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Beyond the "Value Trap"—Defending the $50 Intrinsic Floor

The Concentration Trap: Why the S&P 500 Is No Longer a 'Safe' Diversifier

Transformational Merger

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.