Does Kellton Tech Solutions (NSE:KELLTONTEC) Have A Healthy Balance Sheet?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Kellton Tech Solutions Limited (NSE:KELLTONTEC) does use debt in its business. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Kellton Tech Solutions

What Is Kellton Tech Solutions's Debt?

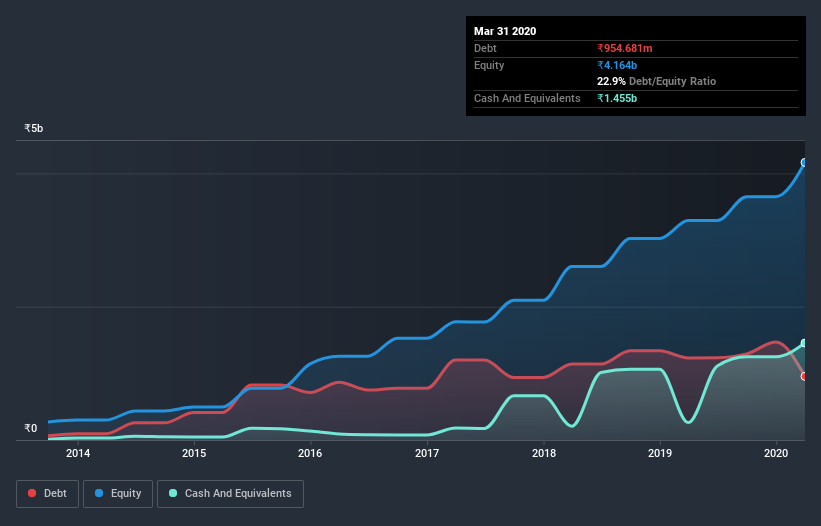

The image below, which you can click on for greater detail, shows that Kellton Tech Solutions had debt of ₹954.7m at the end of March 2020, a reduction from ₹1.23b over a year. However, it does have ₹1.45b in cash offsetting this, leading to net cash of ₹499.9m.

How Strong Is Kellton Tech Solutions's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Kellton Tech Solutions had liabilities of ₹2.12b due within 12 months and liabilities of ₹904.6m due beyond that. Offsetting this, it had ₹1.45b in cash and ₹2.03b in receivables that were due within 12 months. So it actually has ₹459.6m more liquid assets than total liabilities.

This surplus liquidity suggests that Kellton Tech Solutions's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Succinctly put, Kellton Tech Solutions boasts net cash, so it's fair to say it does not have a heavy debt load!

On the other hand, Kellton Tech Solutions saw its EBIT drop by 8.7% in the last twelve months. If earnings continue to decline at that rate the company may have increasing difficulty managing its debt load. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Kellton Tech Solutions will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Kellton Tech Solutions has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Looking at the most recent three years, Kellton Tech Solutions recorded free cash flow of 38% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Summing up

While it is always sensible to investigate a company's debt, in this case Kellton Tech Solutions has ₹499.9m in net cash and a decent-looking balance sheet. So we are not troubled with Kellton Tech Solutions's debt use. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 2 warning signs for Kellton Tech Solutions you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Kellton Tech Solutions, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kellton Tech Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:KELLTONTEC

Kellton Tech Solutions

Provides digital transformation, ERP, and other IT services in Asia Pacific, Europe, the United States, and internationally.

Flawless balance sheet and good value.