- United States

- /

- Electronic Equipment and Components

- /

- NasdaqCM:LPTH

Do Directors Own LightPath Technologies, Inc. (NASDAQ:LPTH) Shares?

A look at the shareholders of LightPath Technologies, Inc. (NASDAQ:LPTH) can tell us which group is most powerful. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. Companies that have been privatized tend to have low insider ownership.

LightPath Technologies is a smaller company with a market capitalization of US$28m, so it may still be flying under the radar of many institutional investors. Taking a look at our data on the ownership groups (below), it's seems that institutions own shares in the company. Let's delve deeper into each type of owner, to discover more about LPTH.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for LightPath Technologies

What Does The Institutional Ownership Tell Us About LightPath Technologies?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

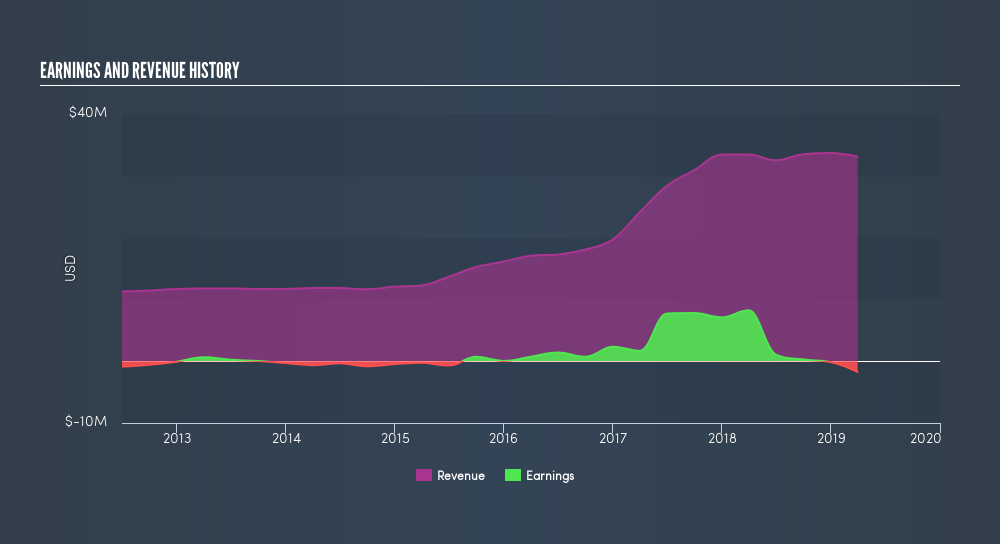

We can see that LightPath Technologies does have institutional investors; and they hold 27% of the stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see LightPath Technologies's historic earnings and revenue, below, but keep in mind there's always more to the story.

LightPath Technologies is not owned by hedge funds. There is a little analyst coverage of the stock, but not much. So there is room for it to gain more coverage.

Insider Ownership Of LightPath Technologies

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

I can report that insiders do own shares in LightPath Technologies, Inc.. As individuals, the insiders collectively own US$1.3m worth of the US$28m company. It is good to see some investment by insiders, but I usually like to see higher insider holdings. It might be worth checking if those insiders have been buying.

General Public Ownership

The general public, who are mostly retail investors, collectively hold 60% of LightPath Technologies shares. This size of ownership gives retail investors collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

Private Equity Ownership

Private equity firms hold a 8.8% stake in LPTH. This suggests they can be influential in key policy decisions. Some investors might be encouraged by this, since private equity are sometimes able to encourage strategies that help the market see the value in the company. Alternatively, those holders might be exiting the investment after taking it public.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand LightPath Technologies better, we need to consider many other factors.

I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:LPTH

LightPath Technologies

Designs, develops, manufactures, and distributes optical systems and assemblies in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Shell PLC (SHEL): The Integrated Energy Arbitrage – Driving Record Buybacks and High-Margin LNG in 2026.

VanEck Semiconductor ETF (SMH): The Silicon Supercycle – Capturing the AI Infrastructure Multiplier in 2026.

Carpenter Technology Corp (CRS): The Titanium Titan – Forging the High-Performance Future of Aerospace in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks