- United States

- /

- Healthtech

- /

- NasdaqGS:DH

Discovering Opportunities: Blade Air Mobility And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

The market has shown positive momentum, rising 1.5% over the last week and climbing 12% over the past year, with earnings projected to grow by 14% annually in the coming years. For investors looking beyond established giants, penny stocks—typically smaller or newer companies—offer unique opportunities that remain relevant despite their somewhat outdated label. By focusing on those with strong balance sheets and solid fundamentals, these stocks can present hidden gems worth exploring for potential growth at lower price points.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Imperial Petroleum (IMPP) | $3.09 | $103.93M | ✅ 4 ⚠️ 1 View Analysis > |

| New Horizon Aircraft (HOVR) | $1.09 | $29.35M | ✅ 4 ⚠️ 5 View Analysis > |

| Waterdrop (WDH) | $1.47 | $533.45M | ✅ 4 ⚠️ 0 View Analysis > |

| Greenland Technologies Holding (GTEC) | $2.09 | $35.83M | ✅ 2 ⚠️ 5 View Analysis > |

| WM Technology (MAPS) | $1.11 | $186.68M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $1.79 | $184.86M | ✅ 4 ⚠️ 0 View Analysis > |

| Table Trac (TBTC) | $4.73 | $22.55M | ✅ 2 ⚠️ 2 View Analysis > |

| Flexible Solutions International (FSI) | $4.325 | $54.64M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.849 | $6.17M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.77 | $76.88M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 709 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Blade Air Mobility (BLDE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blade Air Mobility, Inc. offers air transportation and logistics services for hospitals both in the United States and internationally, with a market cap of approximately $307.87 million.

Operations: The company's revenue is derived from two primary segments: Medical, which generated $146.74 million, and Passenger, contributing $104.75 million.

Market Cap: $307.87M

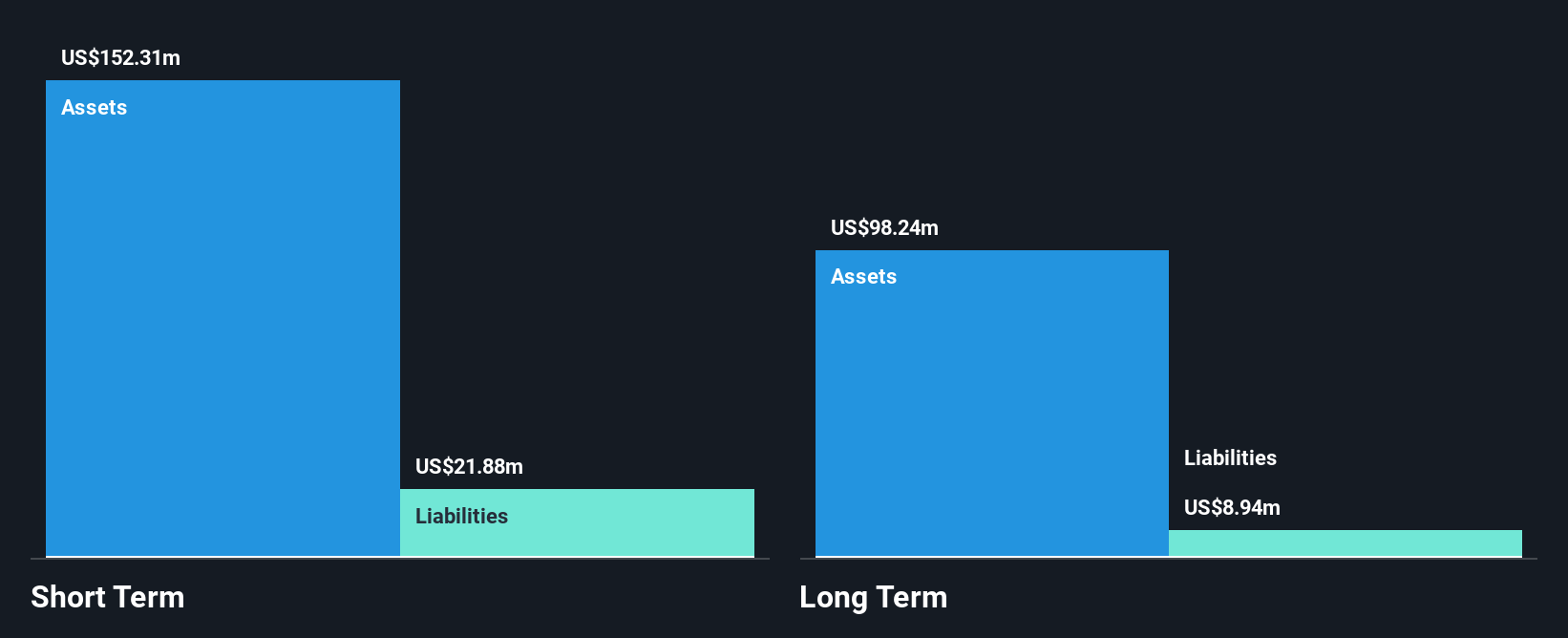

Blade Air Mobility, Inc., with a market cap of US$307.87 million, is navigating the penny stock landscape with its focus on air transportation and logistics services. The company reported Q1 2025 sales of US$54.31 million, an increase from the previous year, though it remains unprofitable with a net loss of US$3.49 million for the quarter. Despite this, Blade's short-term assets significantly exceed both its long-term and short-term liabilities, and it operates debt-free with a stable cash runway exceeding three years. Recent strategic initiatives include expanding urban air mobility services in New York City through partnerships aimed at integrating Electric Vertical Aircraft operations.

- Jump into the full analysis health report here for a deeper understanding of Blade Air Mobility.

- Review our growth performance report to gain insights into Blade Air Mobility's future.

Clean Energy Fuels (CLNE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Clean Energy Fuels Corp. provides natural gas as alternative fuels for vehicle fleets and related fueling solutions in the United States and Canada, with a market cap of $402.19 million.

Operations: The company's revenue is primarily generated from supplying natural gas, amounting to $415.92 million.

Market Cap: $402.19M

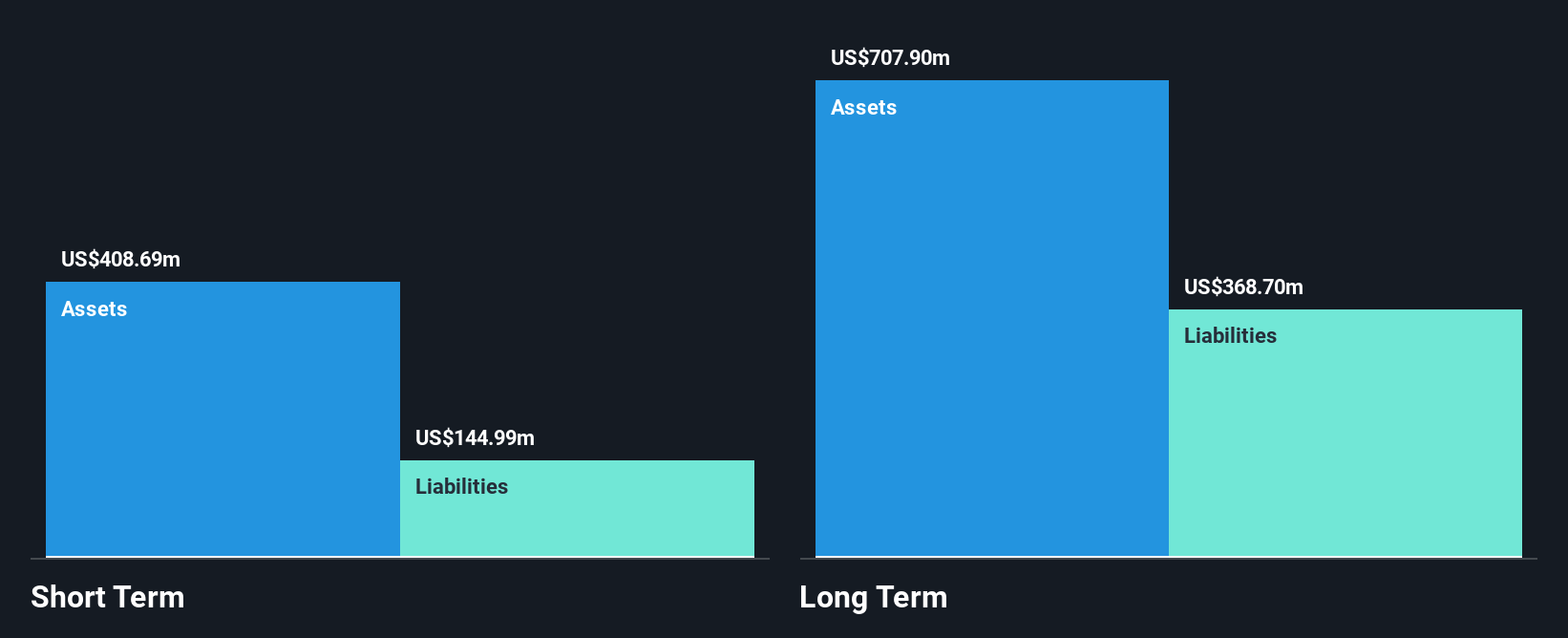

Clean Energy Fuels Corp., with a market cap of US$402.19 million, is navigating challenges typical of penny stocks. Despite generating revenue of US$415.92 million, the company remains unprofitable and has seen losses increase significantly over the past five years. However, it maintains a satisfactory net debt to equity ratio and sufficient cash runway for more than three years if its current free cash flow remains stable. Recent activities include filing a shelf registration for US$19.995 million and reporting a substantial net loss in Q1 2025, alongside significant impairment charges expected this year.

- Dive into the specifics of Clean Energy Fuels here with our thorough balance sheet health report.

- Gain insights into Clean Energy Fuels' future direction by reviewing our growth report.

Definitive Healthcare (DH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Definitive Healthcare Corp. offers a SaaS healthcare commercial intelligence platform both in the United States and internationally, with a market cap of $547.31 million.

Operations: The company generates revenue from its Internet Information Providers segment, amounting to $247.91 million.

Market Cap: $547.31M

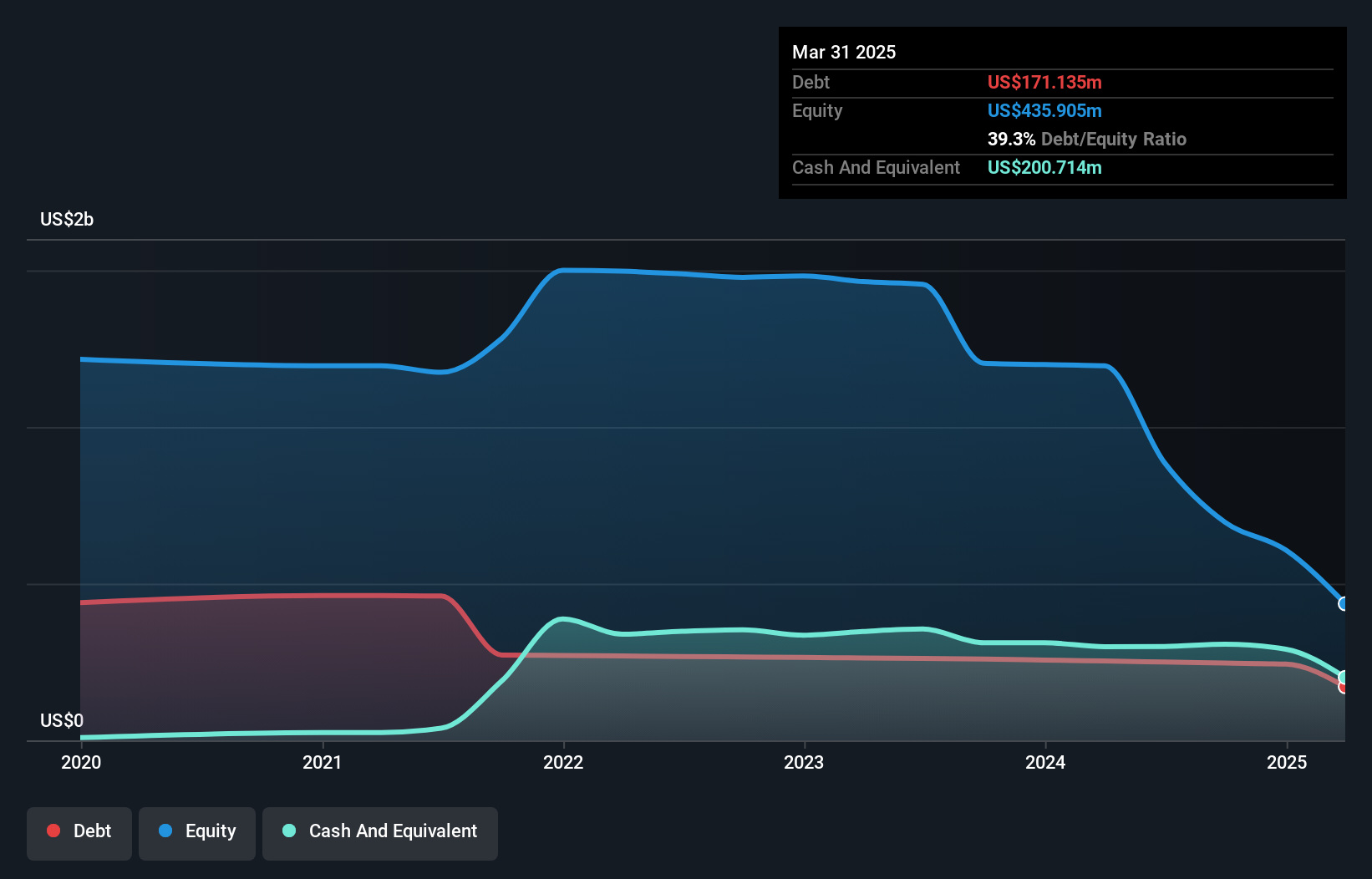

Definitive Healthcare Corp., with a market cap of US$547.31 million, exemplifies the complexities of penny stocks. Despite generating US$247.91 million in revenue, it remains unprofitable and reported a significant net loss increase to US$107.23 million in Q1 2025 from the previous year. The company has a positive cash runway exceeding three years due to stable free cash flow and more cash than debt, but faces challenges with goodwill impairment charges totaling US$176.53 million this quarter. It recently completed a share buyback program and revised its 2025 revenue guidance upward slightly, indicating cautious optimism amidst financial hurdles.

- Click here to discover the nuances of Definitive Healthcare with our detailed analytical financial health report.

- Explore Definitive Healthcare's analyst forecasts in our growth report.

Seize The Opportunity

- Get an in-depth perspective on all 709 US Penny Stocks by using our screener here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DH

Definitive Healthcare

Provides software as a service (SaaS) healthcare commercial intelligence platform in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives