- United States

- /

- Life Sciences

- /

- NasdaqGS:MLAB

Did You Miss Mesa Laboratories's (NASDAQ:MLAB) Whopping 322% Share Price Gain?

We think all investors should try to buy and hold high quality multi-year winners. And highest quality companies can see their share prices grow by huge amounts. Don't believe it? Then look at the Mesa Laboratories, Inc. (NASDAQ:MLAB) share price. It's 322% higher than it was five years ago. And this is just one example of the epic gains achieved by some long term investors. In more good news, the share price has risen -0.1% in thirty days.

Check out our latest analysis for Mesa Laboratories

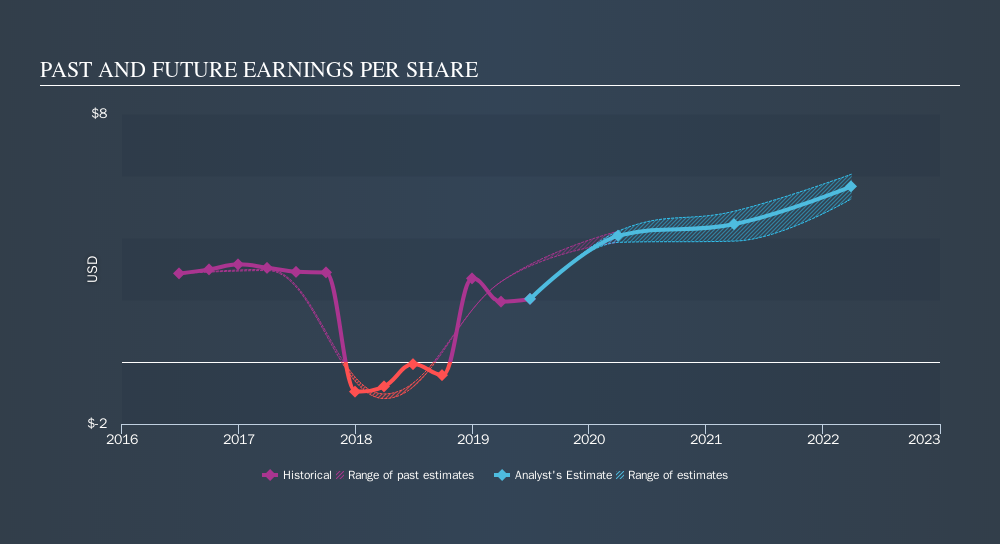

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years of share price growth, Mesa Laboratories moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

You can see below how EPS has changed over time.

We know that Mesa Laboratories has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Mesa Laboratories's TSR for the last 5 years was 333%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Mesa Laboratories has rewarded shareholders with a total shareholder return of 33% in the last twelve months. Of course, that includes the dividend. However, the TSR over five years, coming in at 34% per year, is even more impressive. If you would like to research Mesa Laboratories in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like Mesa Laboratories better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:MLAB

Mesa Laboratories

Develops, designs, manufactures, sells, and services life sciences tools and quality control products and services in North America, Europe, the Asia Pacific, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives