- United States

- /

- Biotech

- /

- NasdaqCM:AGEN

Did You Manage To Avoid Agenus' (NASDAQ:AGEN) Painful 58% Share Price Drop?

Agenus Inc. (NASDAQ:AGEN) shareholders will doubtless be very grateful to see the share price up 70% in the last quarter. But that is little comfort to those holding over the last half decade, sitting on a big loss. The share price has failed to impress anyone , down a sizable 58% during that time. So we're hesitant to put much weight behind the short term increase. We'd err towards caution given the long term under-performance.

Check out our latest analysis for Agenus

Agenus wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over five years, Agenus grew its revenue at 42% per year. That's well above most other pre-profit companies. In contrast, the share price is has averaged a loss of 16% per year - that's quite disappointing. This could mean high expectations have been tempered, potentially because investors are looking to the bottom line. Given the revenue growth we'd consider the stock to be quite an interesting prospect if the company has a clear path to profitability.

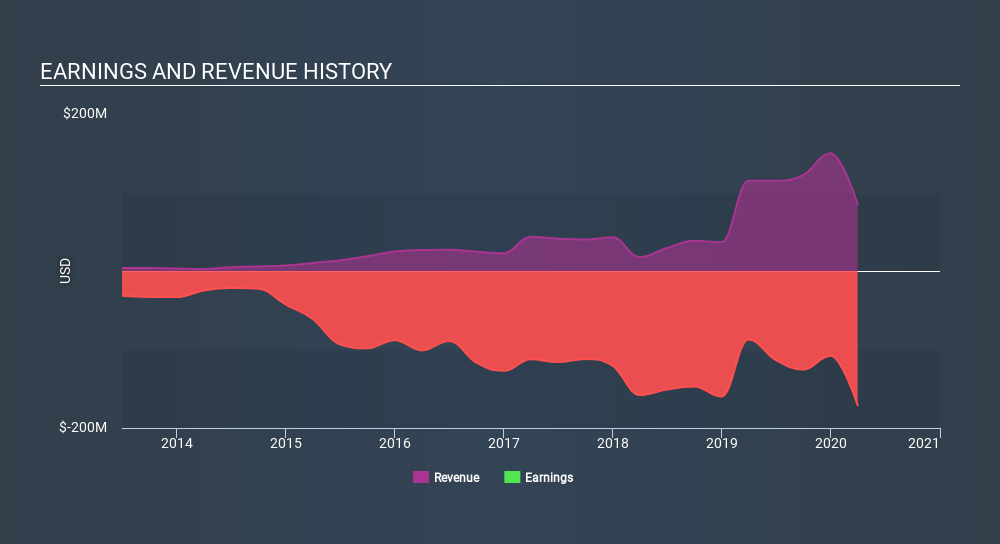

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Agenus stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Agenus shareholders have received a total shareholder return of 24% over one year. There's no doubt those recent returns are much better than the TSR loss of 16% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for Agenus (1 is significant) that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NasdaqCM:AGEN

Agenus

A clinical-stage biotechnology company, discovers and develops therapies to activate the body's immune system against cancer and infections in the United States and internationally.

Good value slight.

Market Insights

Community Narratives