- Hong Kong

- /

- Infrastructure

- /

- SEHK:1052

Did Changing Sentiment Drive Yuexiu Transport Infrastructure's (HKG:1052) Share Price Down By 26%?

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. In contrast individual stocks will provide a wide range of possible returns, and may fall short. One such example is Yuexiu Transport Infrastructure Limited (HKG:1052), which saw its share price fall 26% over a year, against a market return of -18%. Taking the longer term view, the stock fell 21% over the last three years. In the last ninety days we've seen the share price slide 32%. Of course, this share price action may well have been influenced by the 15% decline in the broader market, throughout the period.

Check out our latest analysis for Yuexiu Transport Infrastructure

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the Yuexiu Transport Infrastructure share price fell, it actually saw its earnings per share (EPS) improve by 7.9%. Of course, the situation might betray previous over-optimism about growth.

It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's easy to justify a look at some other metrics.

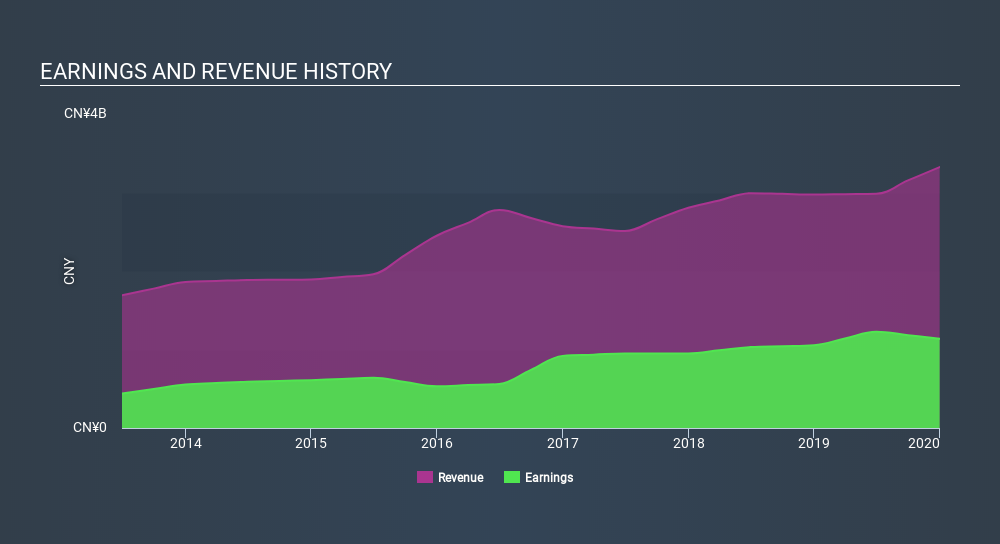

We don't see any weakness in the Yuexiu Transport Infrastructure's dividend so the steady payout can't really explain the share price drop. From what we can see, revenue is pretty flat, so that doesn't really explain the share price drop. Of course, it could simply be that it simply fell short of the market consensus expectations.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Yuexiu Transport Infrastructure's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Yuexiu Transport Infrastructure's TSR for the last year was -21%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We regret to report that Yuexiu Transport Infrastructure shareholders are down 21% for the year (even including dividends) . Unfortunately, that's worse than the broader market decline of 18%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 4.5% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Yuexiu Transport Infrastructure (1 doesn't sit too well with us!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1052

Yuexiu Transport Infrastructure

Invests in, constructs, develops, operates, and manages expressways and bridges in the People’s Republic of China.

Average dividend payer and fair value.

Market Insights

Community Narratives