- United States

- /

- Machinery

- /

- NasdaqCM:NNDM

Did Changing Sentiment Drive Nano Dimension's (NASDAQ:NNDM) Share Price Down A Painful 95%?

Every investor on earth makes bad calls sometimes. But really bad investments should be rare. So consider, for a moment, the misfortune of Nano Dimension Ltd. (NASDAQ:NNDM) investors who have held the stock for three years as it declined a whopping 95%. That would be a disturbing experience. And over the last year the share price fell 83%, so we doubt many shareholders are delighted. The falls have accelerated recently, with the share price down 47% in the last three months.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Check out our latest analysis for Nano Dimension

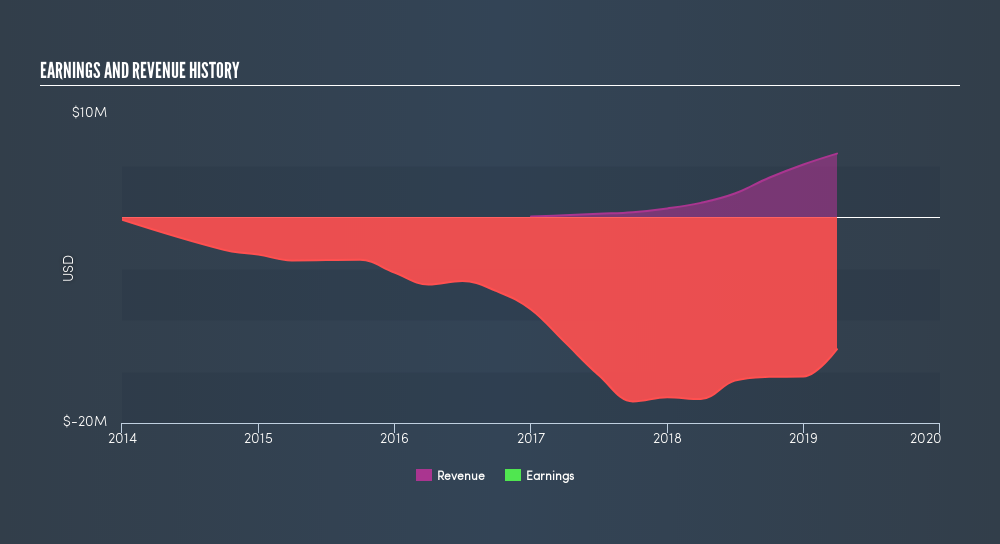

Nano Dimension isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Nano Dimension stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

The last twelve months weren't great for Nano Dimension shares, which cost holders 83%, while the market was up about 0.9%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. The three-year loss of 63% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:NNDM

Nano Dimension

Designs and manufactures systems useful in the electronic fabrication in Israel and Internationally.

Flawless balance sheet minimal.

Market Insights

Community Narratives