- Australia

- /

- Medical Equipment

- /

- ASX:MX1

Did Changing Sentiment Drive Micro-X's (ASX:MX1) Share Price Down A Painful 78%?

As every investor would know, not every swing hits the sweet spot. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of Micro-X Limited (ASX:MX1), who have seen the share price tank a massive 78% over a three year period. That'd be enough to cause even the strongest minds some disquiet. And over the last year the share price fell 62%, so we doubt many shareholders are delighted. The falls have accelerated recently, with the share price down 48% in the last three months. Of course, this share price action may well have been influenced by the 35% decline in the broader market, throughout the period.

View our latest analysis for Micro-X

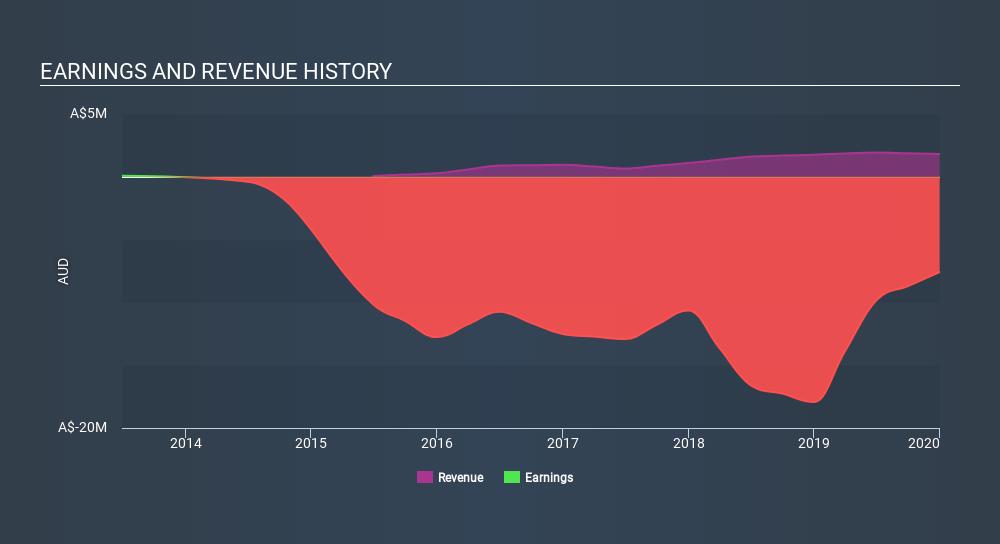

Given that Micro-X didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Micro-X saw its revenue grow by 31% per year, compound. That is faster than most pre-profit companies. So why has the share priced crashed 39% per year, in the same time? You'd want to take a close look at the balance sheet, as well as the losses. Ultimately, revenue growth doesn't amount to much if the business can't scale well. Unless the balance sheet is strong, the company might have to raise capital.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Micro-X's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

The last twelve months weren't great for Micro-X shares, which performed worse than the market, costing holders 62%. The market shed around 25%, no doubt weighing on the stock price. Shareholders have lost 39% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Micro-X better, we need to consider many other factors. Case in point: We've spotted 5 warning signs for Micro-X you should be aware of.

But note: Micro-X may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:MX1

Micro-X

Designs, develops, manufactures, and commercializes healthcare and security markets products using micro-X proprietary cold cathode X-ray technology in Australia, the United States, Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives