- United States

- /

- Auto Components

- /

- NasdaqGS:KNDI

Did Changing Sentiment Drive Kandi Technologies Group's (NASDAQ:KNDI) Share Price Down A Painful 71%?

Long term investing works well, but it doesn't always work for each individual stock. We don't wish catastrophic capital loss on anyone. Anyone who held Kandi Technologies Group, Inc. (NASDAQ:KNDI) for five years would be nursing their metaphorical wounds since the share price dropped 71% in that time. The last week also saw the share price slip down another 6.3%.

View our latest analysis for Kandi Technologies Group

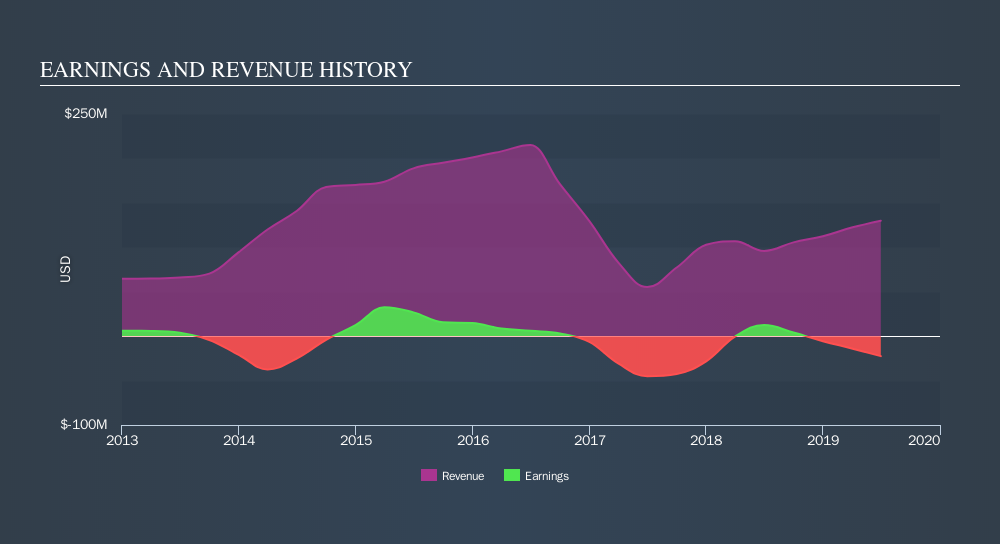

Because Kandi Technologies Group is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over half a decade Kandi Technologies Group reduced its trailing twelve month revenue by 13% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 22% per year in that period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on Kandi Technologies Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Kandi Technologies Group shareholders are up 1.0% for the year. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 22% per year, over five years. It could well be that the business is stabilizing. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Kandi Technologies Group by clicking this link.

Kandi Technologies Group is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:KNDI

Kandi Technologies Group

Engages in designing, developing, manufacturing, and commercializing electric vehicle (EV) products and parts in the People’s Republic of China, the United States and internationally.

Flawless balance sheet very low.

Market Insights

Community Narratives