Stock Analysis

Did Changing Sentiment Drive Bank of India's (NSE:BANKINDIA) Share Price Down A Worrying 70%?

Bank of India Limited (NSE:BANKINDIA) shareholders will doubtless be very grateful to see the share price up 65% in the last month. But don't envy holders -- looking back over 5 years the returns have been really bad. The share price has failed to impress anyone , down a sizable 70% during that time. So we're hesitant to put much weight behind the short term increase. We'd err towards caution given the long term under-performance.

View our latest analysis for Bank of India

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

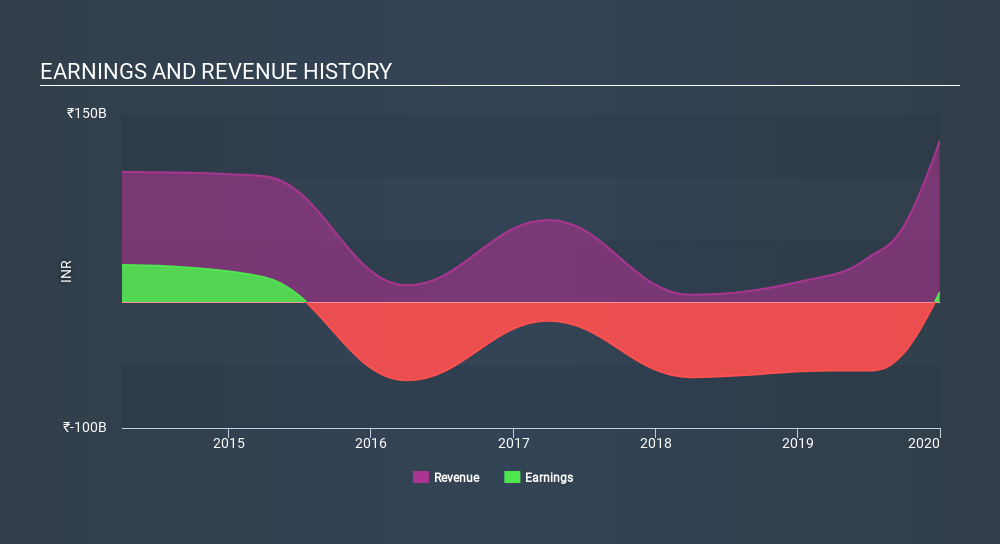

During five years of share price growth, Bank of India moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

Revenue is actually up 1.2% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Bank of India's financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that Bank of India shareholders are down 40% for the year. Unfortunately, that's worse than the broader market decline of 10.0%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 21% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Bank of India better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Bank of India you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NSEI:BANKINDIA

Bank of India

Provides various banking products and services in India and internationally.

Solid track record, good value and pays a dividend.