- United States

- /

- Semiconductors

- /

- NasdaqGS:TER

Did Business Growth Power Teradyne's (NASDAQ:TER) Share Price Gain of 196%?

It hasn't been the best quarter for Teradyne, Inc. (NASDAQ:TER) shareholders, since the share price has fallen 13% in that time. But that doesn't change the fact that the returns over the last five years have been very strong. Indeed, the share price is up an impressive 196% in that time. Generally speaking the long term returns will give you a better idea of business quality than short periods can. The more important question is whether the stock is too cheap or too expensive today.

Check out our latest analysis for Teradyne

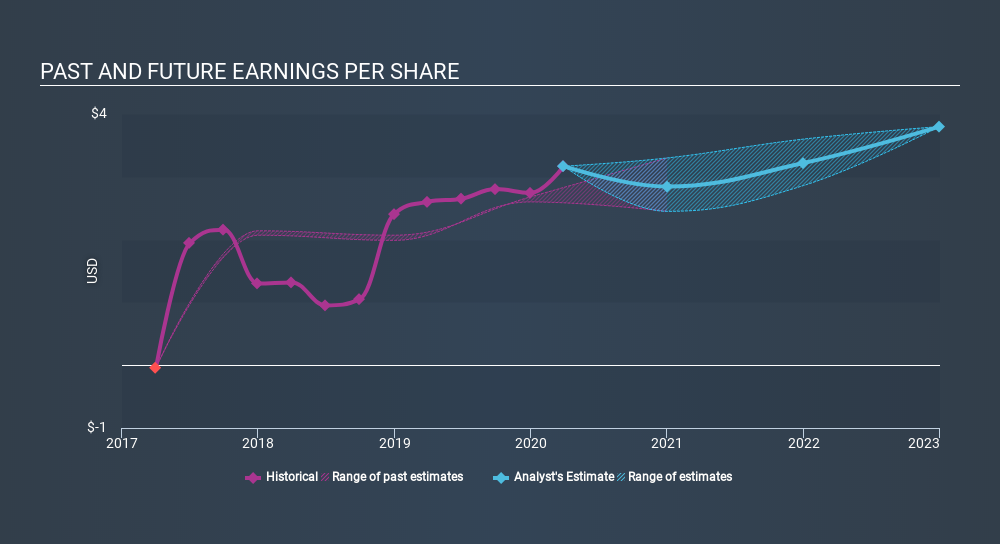

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Teradyne moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It is of course excellent to see how Teradyne has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Teradyne's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Teradyne the TSR over the last 5 years was 211%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that Teradyne has rewarded shareholders with a total shareholder return of 35% in the last twelve months. And that does include the dividend. That's better than the annualised return of 25% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Teradyne that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:TER

Teradyne

Designs, develops, manufactures, and sells automated test systems and robotics products in the United States, Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives