- Australia

- /

- Metals and Mining

- /

- ASX:SRL

Clean TeQ Holdings's (ASX:CLQ) Wonderful 539% Share Price Increase Shows How Capitalism Can Build Wealth

Clean TeQ Holdings Limited (ASX:CLQ) shareholders have seen the share price descend 12% over the month. But that does not change the realty that the stock's performance has been terrific, over five years. In that time, the share price has soared some 539% higher! So it might be that some shareholders are taking profits after good performance. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 30% decline over the last twelve months.

We love happy stories like this one. The company should be really proud of that performance!

View our latest analysis for Clean TeQ Holdings

Clean TeQ Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Clean TeQ Holdings saw its revenue grow at 51% per year. Even measured against other revenue-focussed companies, that's a good result. Fortunately, the market has not missed this, and has pushed the share price up by 45% per year in that time. Despite the strong run, top performers like Clean TeQ Holdings have been known to go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

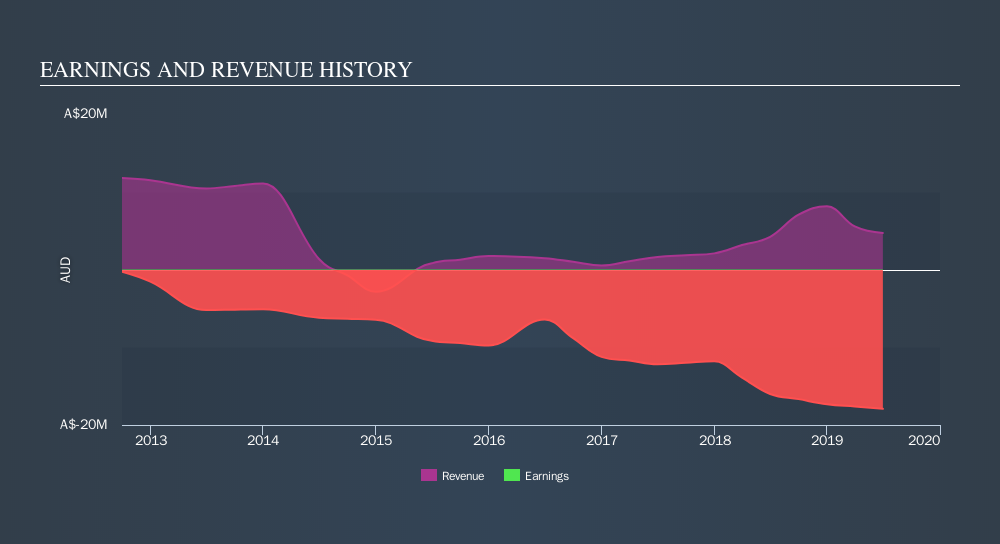

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Clean TeQ Holdings in this interactive graph of future profit estimates.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Clean TeQ Holdings's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Clean TeQ Holdings hasn't been paying dividends, but its TSR of 542% exceeds its share price return of 539%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

While the broader market gained around 13% in the last year, Clean TeQ Holdings shareholders lost 30%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 45%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Clean TeQ Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:SRL

Sunrise Energy Metals

Engages in the metal recovery and exploration of other mineral tenements in Australia.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives