David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that CGN Power Co., Ltd. (HKG:1816) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for CGN Power

How Much Debt Does CGN Power Carry?

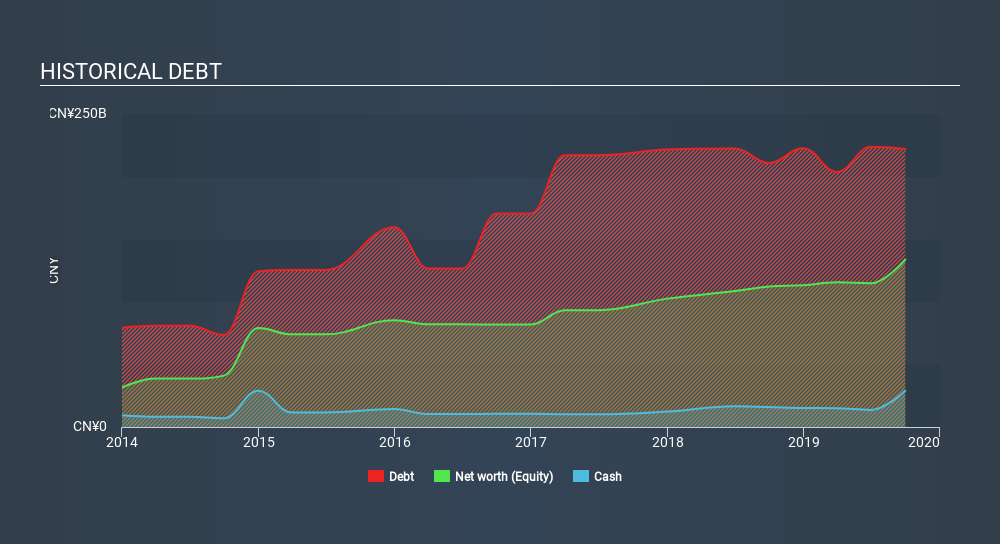

The image below, which you can click on for greater detail, shows that at September 2019 CGN Power had debt of CN¥221.8b, up from CN¥210.8k in one year. However, it does have CN¥28.9b in cash offsetting this, leading to net debt of about CN¥192.9b.

How Healthy Is CGN Power's Balance Sheet?

The latest balance sheet data shows that CGN Power had liabilities of CN¥71.8b due within a year, and liabilities of CN¥190.8b falling due after that. Offsetting these obligations, it had cash of CN¥28.9b as well as receivables valued at CN¥10.8b due within 12 months. So its liabilities total CN¥222.9b more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's huge CN¥165.6b market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

CGN Power has a rather high debt to EBITDA ratio of 6.8 which suggests a meaningful debt load. However, its interest coverage of 4.1 is reasonably strong, which is a good sign. The good news is that CGN Power grew its EBIT a smooth 36% over the last twelve months. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if CGN Power can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, CGN Power's free cash flow amounted to 34% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

To be frank both CGN Power's level of total liabilities and its track record of managing its debt, based on its EBITDA, make us rather uncomfortable with its debt levels. But on the bright side, its EBIT growth rate is a good sign, and makes us more optimistic. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making CGN Power stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. Given CGN Power has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:1816

CGN Power

Generates and sells nuclear power in the People’s Republic of China.

Established dividend payer and fair value.

Market Insights

Community Narratives