- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:241

Can You Imagine How Chuffed Alibaba Health Information Technology's (HKG:241) Shareholders Feel About Its 138% Share Price Gain?

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But if you buy shares in a really great company, you can more than double your money. For example, the Alibaba Health Information Technology Limited (HKG:241) share price has soared 138% in the last three years. Most would be happy with that. Also pleasing for shareholders was the 32% gain in the last three months. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

See our latest analysis for Alibaba Health Information Technology

While Alibaba Health Information Technology made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

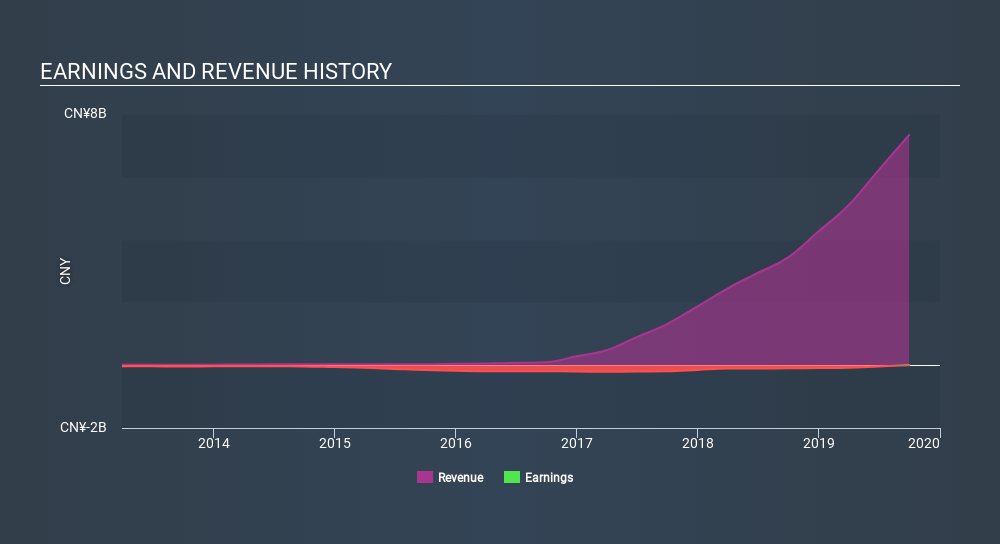

Over the last three years Alibaba Health Information Technology has grown its revenue at 83% annually. That's much better than most loss-making companies. Along the way, the share price gained 33% per year, a solid pop by our standards. But it does seem like the market is paying attention to strong revenue growth. Nonetheless, we'd say Alibaba Health Information Technology is still worth investigating - successful businesses can often keep growing for long periods.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

While the share price may move with revenue, other factors can also play a role. For example, we've discovered 3 warning signs for Alibaba Health Information Technology which any shareholder or potential investor should be aware of.

A Different Perspective

We're pleased to report that Alibaba Health Information Technology shareholders have received a total shareholder return of 51% over one year. That's better than the annualised return of 13% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:241

Alibaba Health Information Technology

An investment holding company, engages in the pharmaceutical direct sales, pharmaceutical e-commerce platform, and healthcare and digital services businesses in Mainland China and Hong Kong.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives