- India

- /

- Trade Distributors

- /

- NSEI:SANGHVIMOV

Can Sanghvi Movers (NSE:SANGHVIMOV) Turn Things Around?

Ignoring the stock price of a company, what are the underlying trends that tell us a business is past the growth phase? Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. This indicates the company is producing less profit from its investments and its total assets are decreasing. In light of that, from a first glance at Sanghvi Movers (NSE:SANGHVIMOV), we've spotted some signs that it could be struggling, so let's investigate.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Sanghvi Movers:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0022 = ₹21m ÷ (₹11b - ₹1.4b) (Based on the trailing twelve months to June 2020).

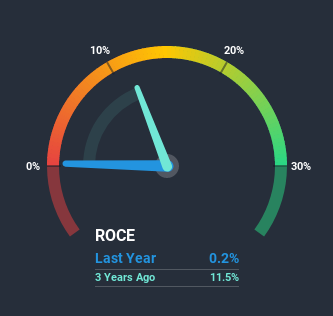

So, Sanghvi Movers has an ROCE of 0.2%. Ultimately, that's a low return and it under-performs the Trade Distributors industry average of 5.0%.

See our latest analysis for Sanghvi Movers

Historical performance is a great place to start when researching a stock so above you can see the gauge for Sanghvi Movers' ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Sanghvi Movers, check out these free graphs here.

What Can We Tell From Sanghvi Movers' ROCE Trend?

There is reason to be cautious about Sanghvi Movers, given the returns are trending downwards. About five years ago, returns on capital were 10%, however they're now substantially lower than that as we saw above. Meanwhile, capital employed in the business has stayed roughly the flat over the period. Since returns are falling and the business has the same amount of assets employed, this can suggest it's a mature business that hasn't had much growth in the last five years. If these trends continue, we wouldn't expect Sanghvi Movers to turn into a multi-bagger.

In Conclusion...

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. Unsurprisingly then, the stock has dived 77% over the last five years, so investors are recognizing these changes and don't like the company's prospects. Unless there is a shift to a more positive trajectory in these metrics, we would look elsewhere.

If you'd like to know more about Sanghvi Movers, we've spotted 3 warning signs, and 2 of them don't sit too well with us.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

When trading Sanghvi Movers or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:SANGHVIMOV

Sanghvi Movers

Operates as a crane rental company in India.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

Rocket Lab - Stock Narrative

Strong buy

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks