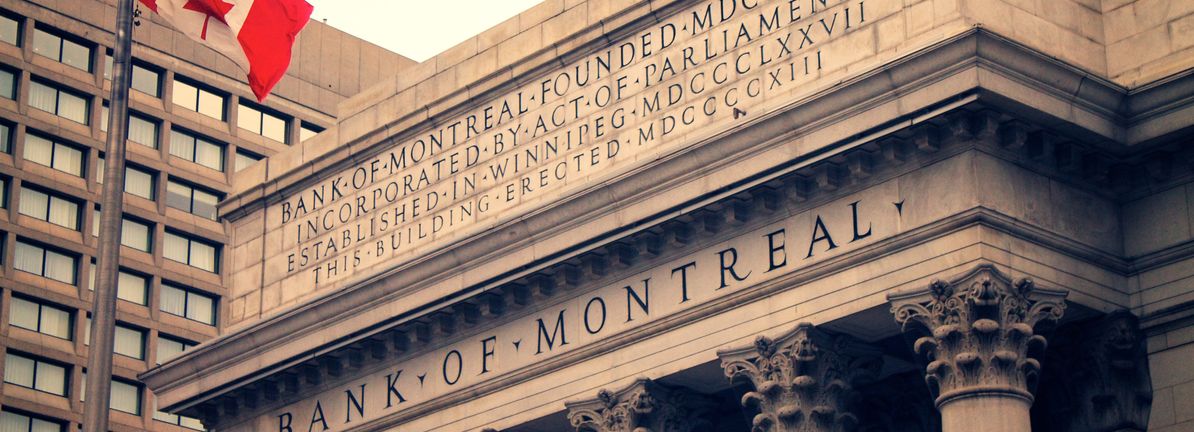

TSX:BMOBanks

Bank Of Montreal Record Results And US Shift Spark Valuation Questions

Bank of Montreal reported record performance to start 2026, with strong results across its core business segments.

The bank is nearing completion of its US optimization strategy, including a sizable reduction in balance sheet loans over the past year.

Return on equity in the US division has improved, supported by a focus on talent and deeper client engagement.

For investors watching TSX:BMO, the latest update comes with the shares trading around CA$193.14 and a 1 year return of 42.1%. Over...