- United States

- /

- Renewable Energy

- /

- OTCPK:AZRE.F

Azure Power Global Limited (NYSE:AZRE) Analysts Are Cutting Their Estimates: Here's What You Need To Know

It's been a good week for Azure Power Global Limited (NYSE:AZRE) shareholders, because the company has just released its latest annual results, and the shares gained 3.6% to US$15.43. It was a pretty bad result overall; while revenues were in line with expectations at ₹13b, statutory losses exploded to ₹52.71 per share. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

Check out our latest analysis for Azure Power Global

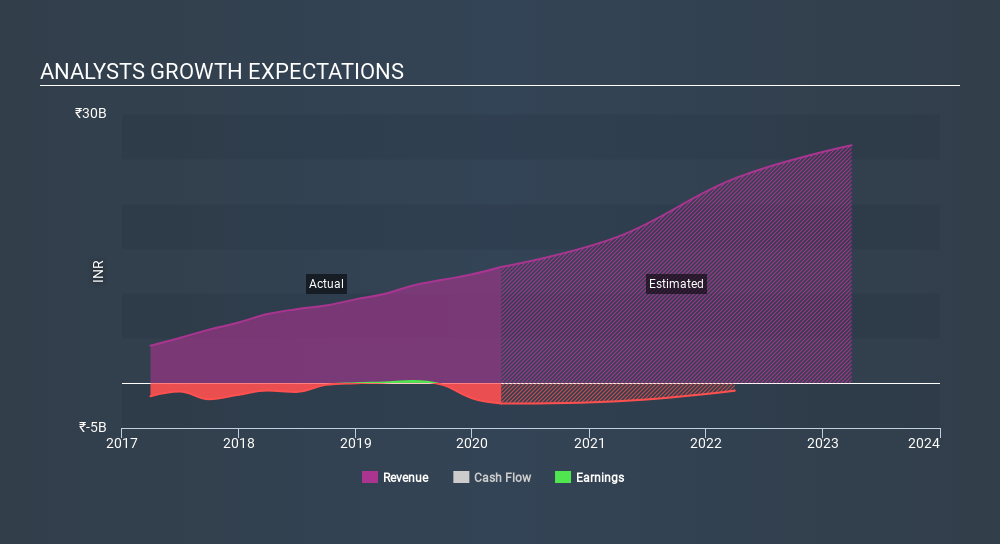

Taking into account the latest results, the most recent consensus for Azure Power Global from four analysts is for revenues of ₹16.3b in 2021 which, if met, would be a major 26% increase on its sales over the past 12 months. Losses are predicted to fall substantially, shrinking 66% to ₹17.76. Before this latest report, the consensus had been expecting revenues of ₹17.6b and ₹6.96 per share in losses. So it's pretty clear the analysts have mixed opinions on Azure Power Global after this update; revenues were downgraded and per-share losses expected to increase.

There was no major change to the consensus price target of US$21.87, signalling that the business is performing roughly in line with expectations, despite lower earnings per share forecasts. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Azure Power Global analyst has a price target of US$30.00 per share, while the most pessimistic values it at US$15.20. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that Azure Power Global's revenue growth is expected to slow, with forecast 26% increase next year well below the historical 39%p.a. growth over the last five years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 3.8% next year. Even after the forecast slowdown in growth, it seems obvious that Azure Power Global is also expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts increased their loss per share estimates for next year. They also downgraded their revenue estimates, although industry data suggests that Azure Power Global's revenues are expected to grow faster than the wider industry. The consensus price target held steady at ₹21.87, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on Azure Power Global. Long-term earnings power is much more important than next year's profits. We have forecasts for Azure Power Global going out to 2023, and you can see them free on our platform here.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Azure Power Global (1 is a bit concerning!) that you need to be mindful of.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About OTCPK:AZRE.F

Azure Power Global

Operates as a renewable energy developer and independent renewable power producer in India.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success