When Mandalay Resources Corporation (TSE:MND) reported its results to December 2019 its auditors, Ernst & Young LLP could not be sure that it would be able to continue as a going concern in the next year. It is therefore fair to assume that, based on those financials, the company should strengthen its balance sheet in the short term, perhaps by issuing shares.

Given its situation, it may not be in a good position to raise capital on favorable terms. So it is suddenly extremely important to consider whether the company is taking too much risk on its balance sheet. The big consideration is whether it can repay its debt, since in the worst case scenario, creditors could force the company to bankruptcy.

Check out our latest analysis for Mandalay Resources

What Is Mandalay Resources's Net Debt?

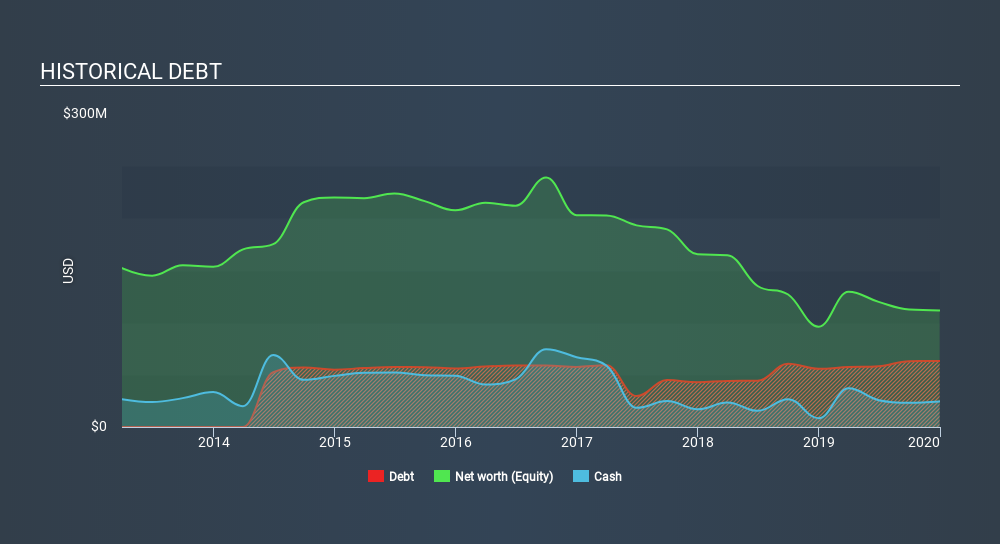

The image below, which you can click on for greater detail, shows that at December 2019 Mandalay Resources had debt of US$63.3m, up from US$55.8m in one year. However, it also had US$24.5m in cash, and so its net debt is US$38.8m.

How Strong Is Mandalay Resources's Balance Sheet?

The latest balance sheet data shows that Mandalay Resources had liabilities of US$104.0m due within a year, and liabilities of US$42.8m falling due after that. On the other hand, it had cash of US$24.5m and US$11.9m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$110.5m.

This deficit casts a shadow over the US$66.5m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Mandalay Resources would probably need a major re-capitalization if its creditors were to demand repayment. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Mandalay Resources can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Mandalay Resources had negative earnings before interest and tax, and actually shrunk its revenue by 3.9%, to US$108m. That's not what we would hope to see.

Caveat Emptor

Over the last twelve months Mandalay Resources produced an earnings before interest and tax (EBIT) loss. Indeed, it lost a very considerable US$15m at the EBIT level. When we look at that alongside the significant liabilities, we're not particularly confident about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it had negative free cash flow of US$28m over the last twelve months. So suffice it to say we consider the stock to be risky. We're too cautious to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. That's because companies should always make sure the auditor has confidence that the company will continue as a going concern, in our view. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 5 warning signs we've spotted with Mandalay Resources (including 2 which is make us uncomfortable) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:MND

Mandalay Resources

Engages in the acquisition, exploration, extraction, processing, and reclamation of mineral properties in Australia, Sweden, Chile, and Canada.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives